Hello friends,

We’re back with new unbiased data for this week of the US stock market.

If you like my writing, please consider liking and restacking this post!

The Stock Insider ETF Update

We're making an important change to how we will communicate updates about the Stock Insider portfolio. We're moving from SMS to Telegram, and here's what you need to know:

Why We're Switching to Telegram

Regulatory Complexities: We encountered two main challenges with SMS over the last weeks:

The interaction between standard privacy policies and Twilio's A2P (Application-to-Person) guidelines creates complex compliance requirements for SMS services creating a risk that the service could be terminated at any time.

T-Mobile raised concerns last week about messages potentially being interpreted as financial advice and advised changes which would require extremely careful wording.

Telegram’s Free Speech: We can provide you with real-time, unedited information about market movements and our portfolio decisions. This platform enables more open dialogues about investment strategies and market dynamics. Telegram, similar to Substack, has a more permissive approach to content compared to many other platforms.

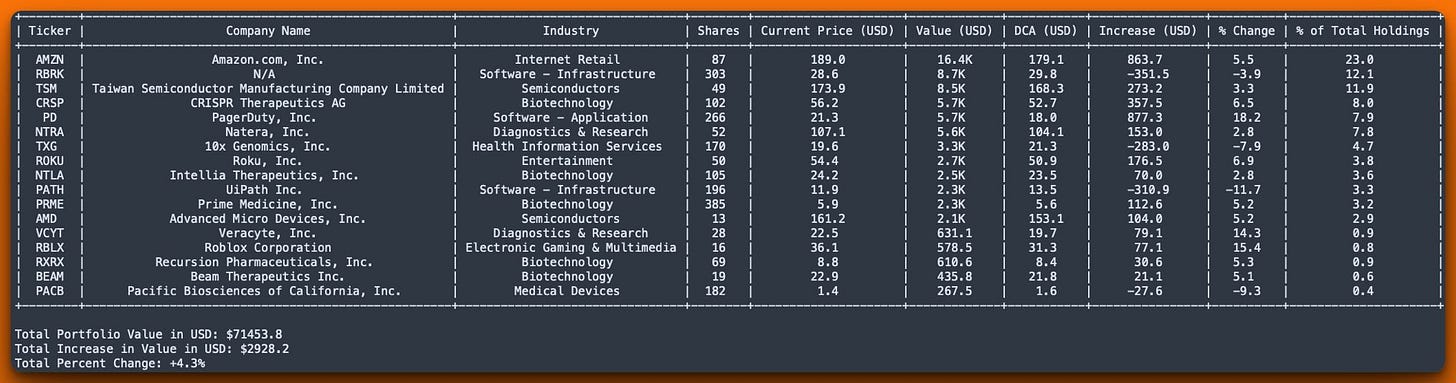

Enhanced Content: Telegram allows us to share images, graphs, and detailed portfolio information, like this recent snapshot of our real holdings:

Better Interaction: Telegram allows for more interactive features, including bots to help explain portfolio status.

Customizable Notifications: You can set your preferences to receive alerts similar to SMS text messages.

Improved Communication and Privacy: Telegram gives us more flexibility in sharing insights while maintaining your privacy. We don’t need to know your phone number or name.

What This Means For You

You'll receive more comprehensive updates about the Stock Insider portfolio.

The educational value of following our trades and strategy will be enhanced.

You'll have a richer, more interactive experience overall.

We can communicate more freely without navigating the complex regulatory landscape of SMS messaging.

When Are We Launching?

You might be wondering about our launch timing. Here's what you need to know:

Proven Market Timing Strategy: For over 10 years, I've been successfully timing the market using a specific method. While many say you can't time the market, my experience suggests otherwise.

Inspiration from Warren Buffett: My approach is inspired by Warren Buffett's insights on achieving significant returns. If you haven't seen it, I highly recommend watching "Warren Buffett Explains How To Make A 50% Return Per Year". Buffett's principles have been instrumental in shaping my strategy.

Warren Buffett suggests achieving high returns by:

Focus on Your Expertise: Invest in sectors you deeply understand (mine — tech).

Target Emerging Companies: Look for promising, undervalued businesses with growth potential.

Do Thorough Research: Understand the company's model, advantages, and market potential.

Be Patient and Selective: Wait for the right opportunities that align with your knowledge.

Remember, in the investment world, timing is everything. Our goal is to start strong and provide you with the most valuable learning experience from day one.

When the Stock Insider ETF launches

New premium subscribers will receive the Telegram channel invitation in their welcome email.

Existing premium subscribers will be sent the channel invitation before launch.

Remember, the Stock Insider portfolio is for educational purposes only. All trades are made with my personal funds and are not open to outside investment. This is not financial advice - always do your own research before making investment decisions. Do not invest what you can’t afford to lose.

We're excited about this change and the improved experience it will bring to our subscribers.

Thank you for your continued interest in learning from our Stock Insider journey!

Today’s extras in the premium section

NVIDIA short- and mid-term technical analysis.

This week’s developments

Working on the change from SMS to Telegram channel for the Stock Insider ETF.

Improved screeners quant data.

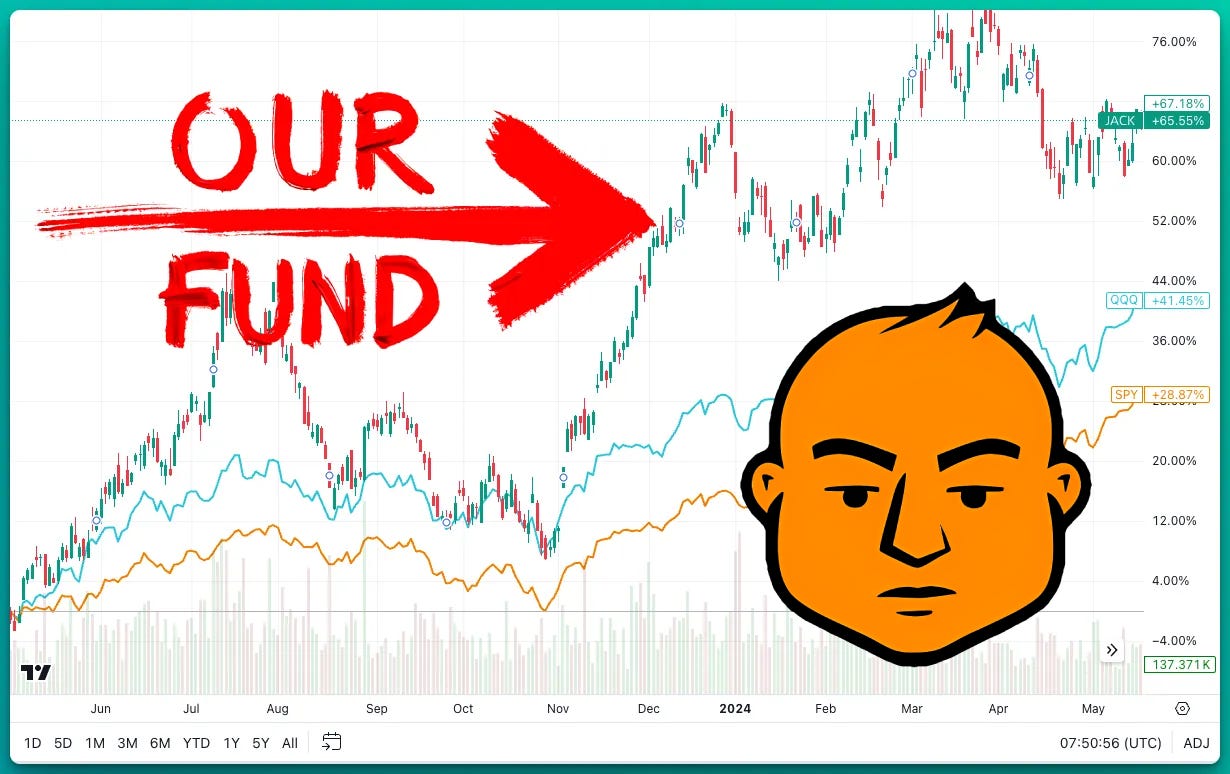

This graph was generated by our friends at TradingView. Did you know you can get 60% off the Premium plan forever even though it's not Black Friday?

My company is tracking over 2,000 tickers over 1B market cap daily traded in the US which we’re analyzing, in depth, using both quantitative systems and professional review.

We are using tools that cost $30k+/month to bring this data to you.

If we ever launch more newsletters, you will always find them at DailyMoat.com

Let’s move on with the newsletter:

S&P500 Heatmap for the last week

Please send feedback and ideas using comments or email. I answer emails personally.

And, as always — stay informed — and do your own due diligence,

Jack from The Daily Moat

Below is the data for premium members, the data that allowed us to beat the stock market for over a decade.

More Suitable for Long-Term Investors:

Reliable Value Finds

Top Trusted Value Picks

Smart Growth Stocks

Steady Performer Stocks

Suitable for Short-Term Investors:

Best Sales Price Stocks

Best Book Value Stocks

Reliable High Dividend Earners

Insider-Favored Low Price Stocks

Insider-Favored High Price Stocks

Cheers!

Keep reading with a 7-day free trial

Subscribe to The Stock Insider to keep reading this post and get 7 days of free access to the full post archives.