How to Completely Automate Your Finances After Receiving Your Salary – First Step to Building Multi-Generational Wealth

Taking Action: Your Roadmap to Financial Autonomy

Even among high earners, it's astonishing how many feel like their money vanishes the moment it arrives.

The culprit? A lack of a structured paycheck routine.

Instead of proactively directing their money, they reactively spend what's in front of them. Without a plan, expenses expand to fill the income available—often leaving little to show for years of hard work.

Imagine a system where your money works for you automatically, funneling into investments, savings, and essential expenses without constant oversight.

A system that not only preserves your wealth but actively grows it, setting the foundation for multi-generational prosperity.

The Power of Automation in Wealth Building

By setting up an automated financial system, you eliminate the friction of manual money management and the risk of human error—or human emotion. Automation ensures consistency, which is crucial for long-term wealth accumulation.

But how do you transition from a haphazard approach to a streamlined, automated system?

Step 1: Architecting Your Financial Infrastructure

To begin, you need a solid financial architecture—a network of linked accounts that seamlessly direct your income to its optimal destinations. It's about designing a system that aligns with your financial goals and investment strategies.

Here's where many people make mistakes: they underestimate the importance of a well-thought-out account structure. It's about optimizing the flow of funds to maximize growth and minimize waste.

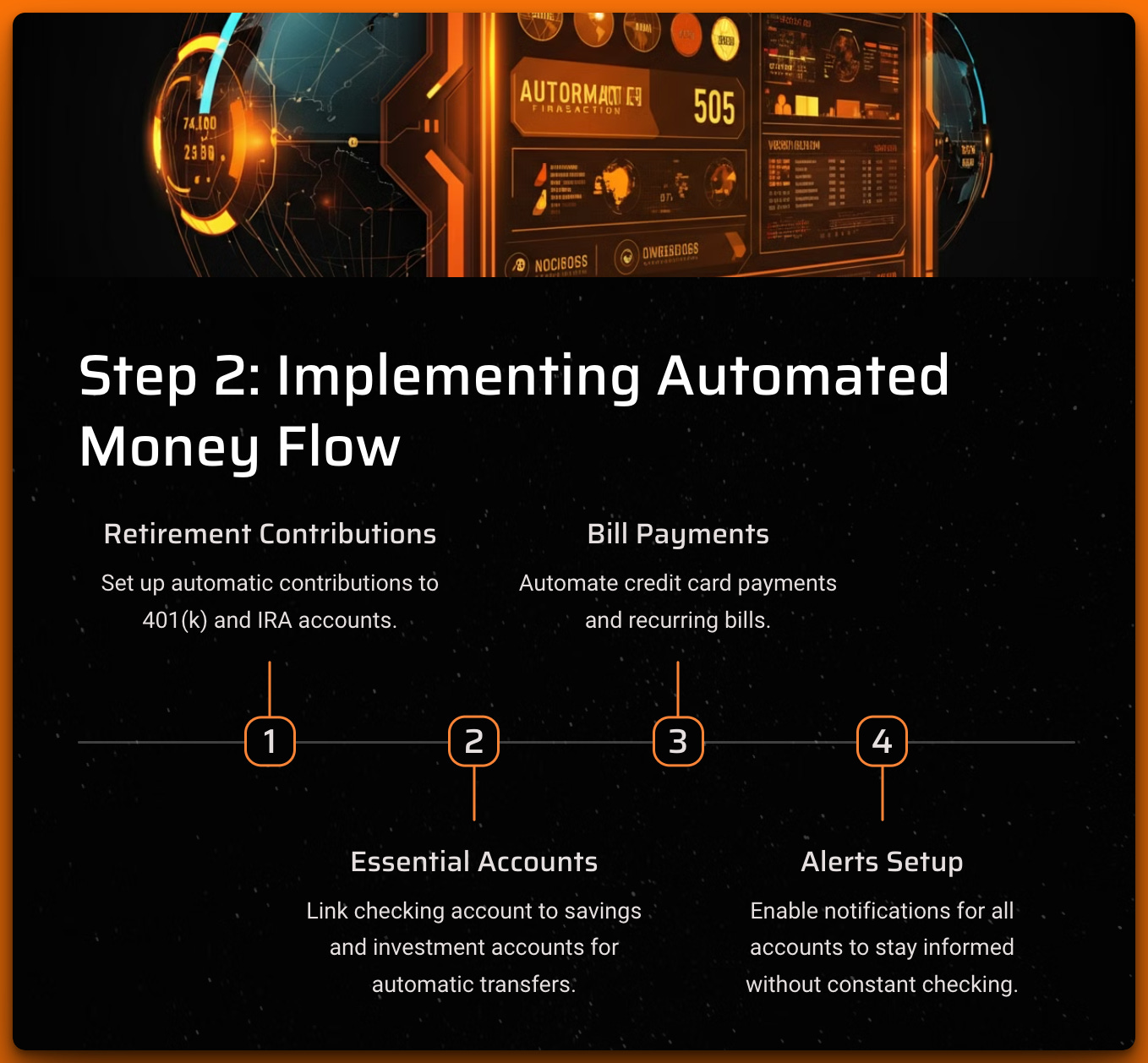

Step 2: Implementing an Automated Money Flow System

With your financial infrastructure in place, the next critical move is to establish an automated money flow system. This system ensures that every dollar you earn is purposefully allocated without requiring constant oversight.

Here's how to set it up effectively:

Automate Your Retirement Contributions

Employer-Sponsored Plans: If you haven't already, set up automatic contributions to your 401(k) or equivalent retirement plan through your employer. This often occurs before your paycheck reaches your bank account, maximizing your tax advantages and retirement savings effortlessly.

Individual Retirement Accounts (IRAs): Link your checking account to your Roth IRA or Traditional IRA. Schedule automatic monthly contributions that align with your retirement goals and annual contribution limits.

Link Your Checking Account to Essential Accounts

Savings Accounts: Set up automatic transfers to your high-yield savings accounts for your emergency fund and other short-term goals.

Investment Accounts: Connect to your brokerage accounts for taxable investments. Automate investments into index funds, ETFs, or other assets according to your investment strategy.

Debt Payments: For any loans or debts that can't be paid with a credit card (like mortgages or student loans), set up automatic payments from your checking account.

Automate Your Bill Payments

Credit Cards: Schedule automatic payments to pay off your credit card balances in full each month. This avoids interest charges and keeps your credit score healthy.

Utilities and Subscriptions: Use your credit card to pay for utilities, subscriptions, and other recurring expenses to earn rewards and simplify tracking.

Rent or Mortgage: If your landlord or lender doesn't accept credit cards, use your bank's bill pay feature to automate these payments.

Set Up Alerts and Notifications

Enable email or text notifications for all your accounts. This keeps you informed about transactions, due dates, and any unusual activity without requiring constant manual checking.

Step 3: Optimizing Payment Schedules for Seamless Cash Flow

Keep reading with a 7-day free trial

Subscribe to The Stock Insider to keep reading this post and get 7 days of free access to the full post archives.