Potential Returns: 💰💰💰💰⚪️(4/5)

Risk Level: 🛡️⚪️⚪️⚪️⚪️ (1/5)

Complexity: ⚪️⚪️⚪️⚪️⚪️ (0/5)

The financial landscape is riddled with uncertainties—inflation spikes, deflation threats, economic booms, and busts. Traditional portfolios often falter under such volatility.

Enter the All-Weather Portfolio, a strategy engineered to perform across all economic climates.

Originally conceptualized by Ray Dalio of Bridgewater Associates, this portfolio is designed to mitigate risks and reduce volatility, ensuring that your investments are protected no matter what the market throws your way.

I've adapted his strategy for today's market into a 3-ETF version, without compromising its robustness.

Why an Adapted All-Weather Portfolio Now?

1. Market Volatility Is the New Normal

Global events have made markets more unpredictable than ever. From pandemics to geopolitical tensions, investors are seeking refuge in strategies that offer stability.

2. Complexity Isn't Always Better

While diversification is key, overcomplicating your portfolio can lead to analysis paralysis. An adapted approach allows for easier management and clearer understanding of where your money is invested.

3. Accessibility for All Investors

Not everyone has access to hedge funds or wants to manage a portfolio with dozens of assets. A 3-ETF portfolio democratizes the All-Weather strategy, making it accessible to retail investors.

The Core Principles Behind the Strategy

Ray Dalio identified four economic seasons:

Higher than expected inflation

Lower than expected inflation (deflation)

Higher than expected economic growth

Lower than expected economic growth

To thrive in all these conditions, a portfolio must be diversified across asset classes that perform differently in each scenario. The goal is to balance risk and reward so that when one asset falters, others pick up the slack.

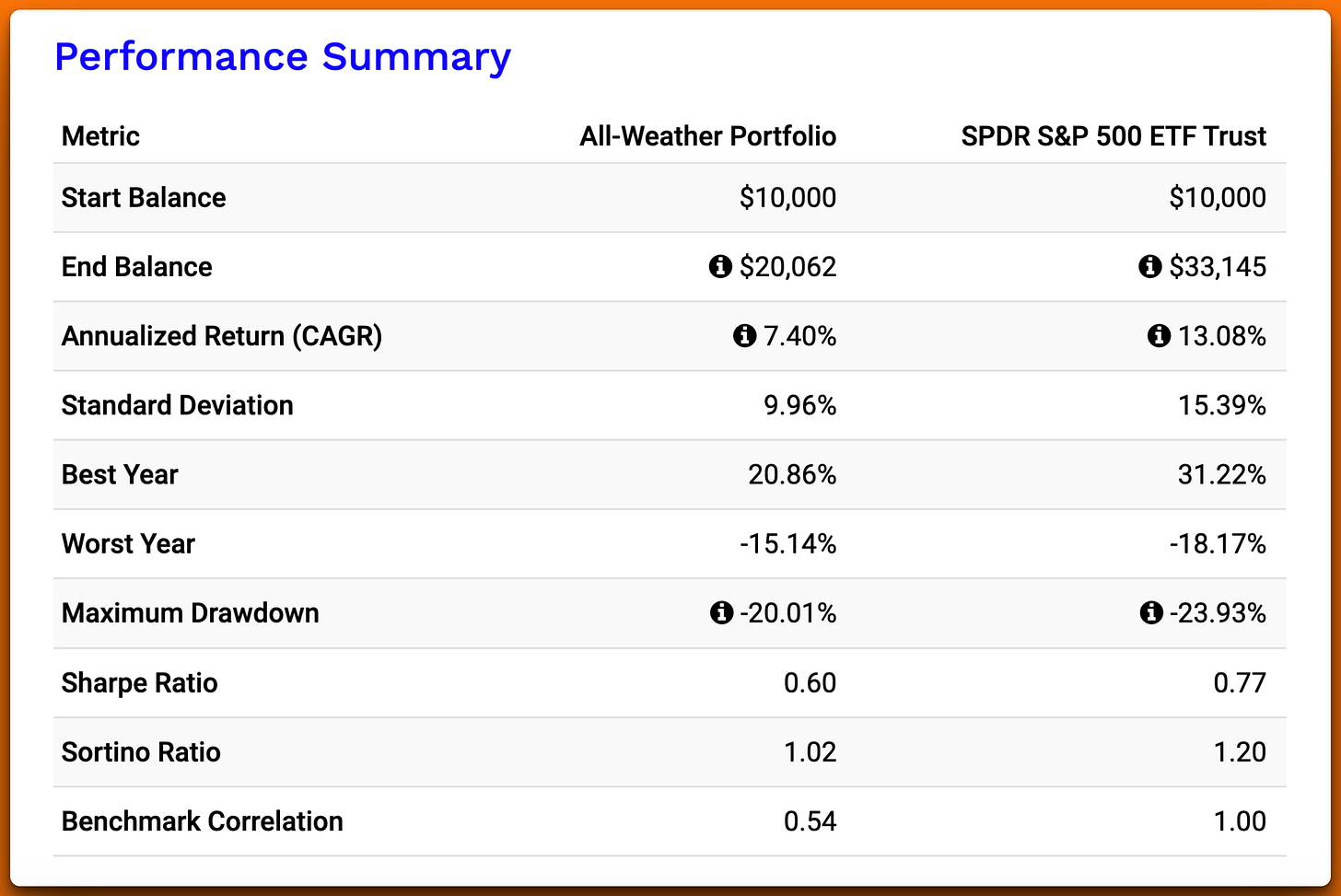

Performance Highlights

Let's delve into some hard data to understand how a Adapted All-Weather Portfolio stacks up against traditional investments.

Historical Performance (2004–2022)

Initial Investment: $10,000

Ending Balance:

Adapted All-Weather Portfolio: $20,062

S&P 500 Index: $33,145

Annualized Return (CAGR)

Adapted All-Weather Portfolio: 7.40%

S&P 500 Index: 13.08%

Standard Deviation (Risk Measure)

Adapted All-Weather Portfolio: 9.96%

S&P 500 Index: 15.39%

Maximum Drawdown

Adapted All-Weather Portfolio: -20.01%

S&P 500 Index: -23.93%

Interpretation: While the Adapted All-Weather Portfolio delivers lower returns compared to the S&P 500, it does so with significantly less volatility and smaller drawdowns. For investors prioritizing capital preservation, this trade-off is often acceptable.

Is This Strategy Right for You?

This portfolio is ideal for:

Risk-Averse Investors: Those who prioritize capital preservation over high returns.

Retirees or Near-Retirees: Individuals who cannot afford significant losses.

Hands-Off Investors: Those who prefer a "set it and forget it" approach without frequent adjustments.

However, if you're seeking aggressive growth and can tolerate higher volatility, this may not align with your investment goals.

The Psychological Advantage

Investing isn't just about numbers; it's also about how you react to market swings. High volatility can lead to emotional decision-making, often resulting in buying high and selling low.

By reducing portfolio volatility, you're less likely to make impulsive decisions based on fear or greed. This psychological comfort can be invaluable, allowing you to stay the course during turbulent times.

For European Investors: Tailored Solutions Await

If you're based in the EU, you might face restrictions accessing certain U.S.-domiciled ETFs due to regulatory policies. But don't worry—I've got you covered. Subscribers will gain access to equivalent UCITS-compliant ETFs that mirror the strategy's objectives.

Crafting the Portfolio: The Three ETFs Revealed:

Keep reading with a 7-day free trial

Subscribe to The Stock Insider to keep reading this post and get 7 days of free access to the full post archives.