TL;DR

Reddit RDDT 1.27%↑ just reported a blow-out quarter, but the stock is down double digits after hours.

It seems investors were not pleased with user growth, but the company still delivered strong earnings and guidance

It’s time to dig deep into the latest earnings report and answer one key question.

Is this a dip buying opportunity?

Expect To Learn

Why Reddit Is Tanking After Earnings

The 4 Reasons I Am Bullish Reddit

Price Target for 2026

Risks And Threat Analysis

I recommended Reddit to my readers back in November, and the stock has done very well since then. While I can understand the desire to take profit, this stock still has plenty of room to run.

But first, a little bit about me, The Pragmatic Investor

An approach that assesses the truth of meaning of theories or beliefs in terms of the success of their practical application.

That is Pragmatism, and it guides my investment philosophy.

Through many years of analyzing markets, I have found this is what works.

The Pragmatic Investor sticks to what works. The problem is there are thousands of different strategies that CAN work for certain people.

But simplicity is key, and that is why I have narrowed down my investing ethos into three key ideas, which combined create what I like to call, The Pragmatic Investing Pyramid.

Macro, Fundamentals and Technical.

This is the three-pronged approach that has helped me beat markets over the last seven years.

For long-term investing, there’s nothing better than understanding business cycles, macroeconomic trends and geopolitics.

On the other hand, when it comes to short-term moves in markets, the best tool we have is technical analysis.

And not just a specific form of technical analysis but a robust set of tools that can all work in conjunction to help us find great setups.

I actually recently designed my own algorithm, you can see it here:

My Substack is designed to guide investors of all levels in their journey.

Understand markets with the weekly newsletter.

Build a diversified global portfolio that will stand the test of time.

Get actionable trade ideas to take your investment returns to the next level.

Every week I give a macro update, a technical analysis update on the main indexes and stocks and I cover a stock in-depth, looking at its fundamentals.

Q4 2024 Overview

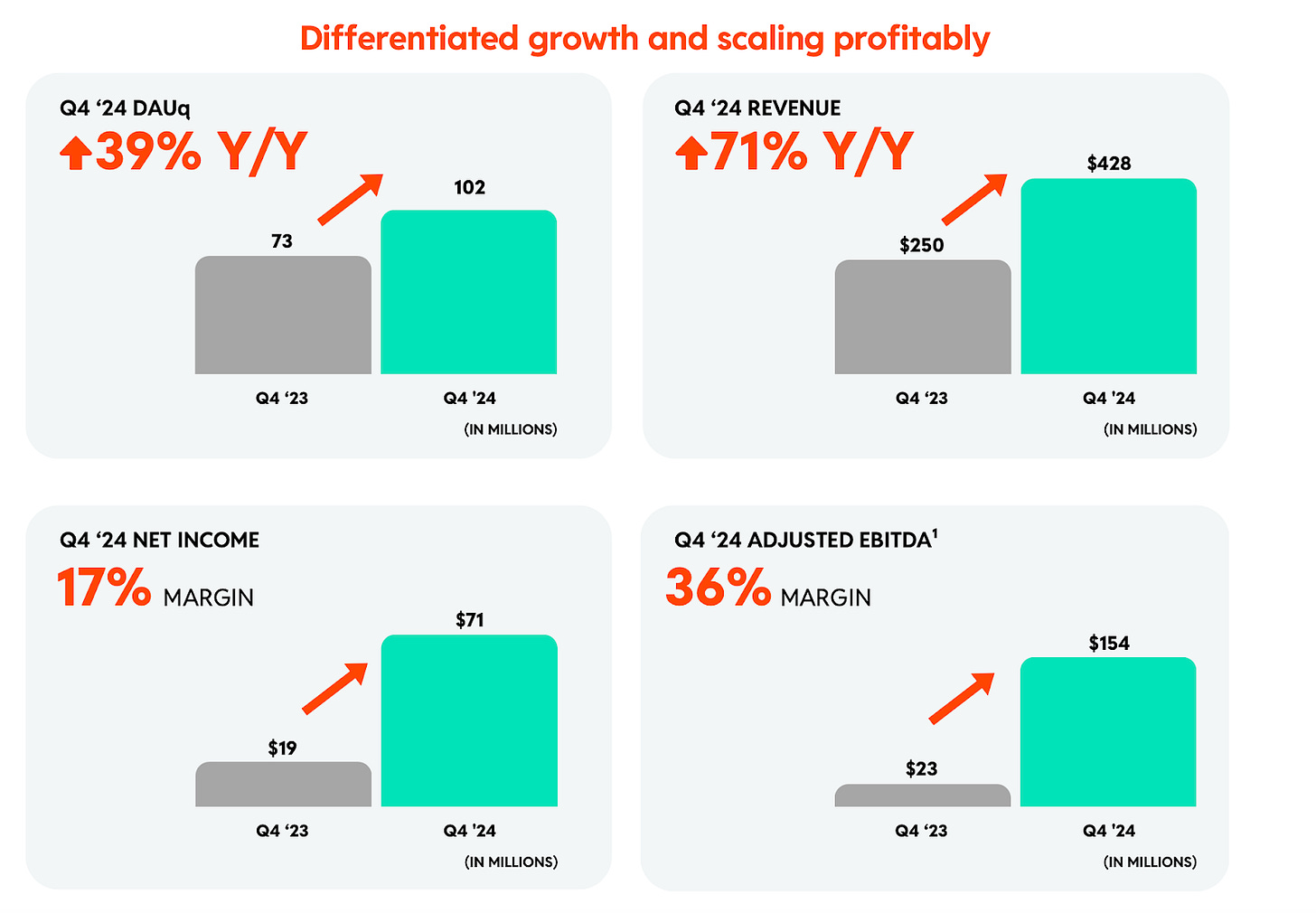

Reddit closed out 2024 with a strong fourth quarter, marking its second consecutive GAAP-profitable quarter. Revenue reached $427.7 million, up 71% YoY, while net income came in at $71 million with a 16.6% margin. Adjusted EBITDA rose to $154.3 million, with a margin of 36.1%.

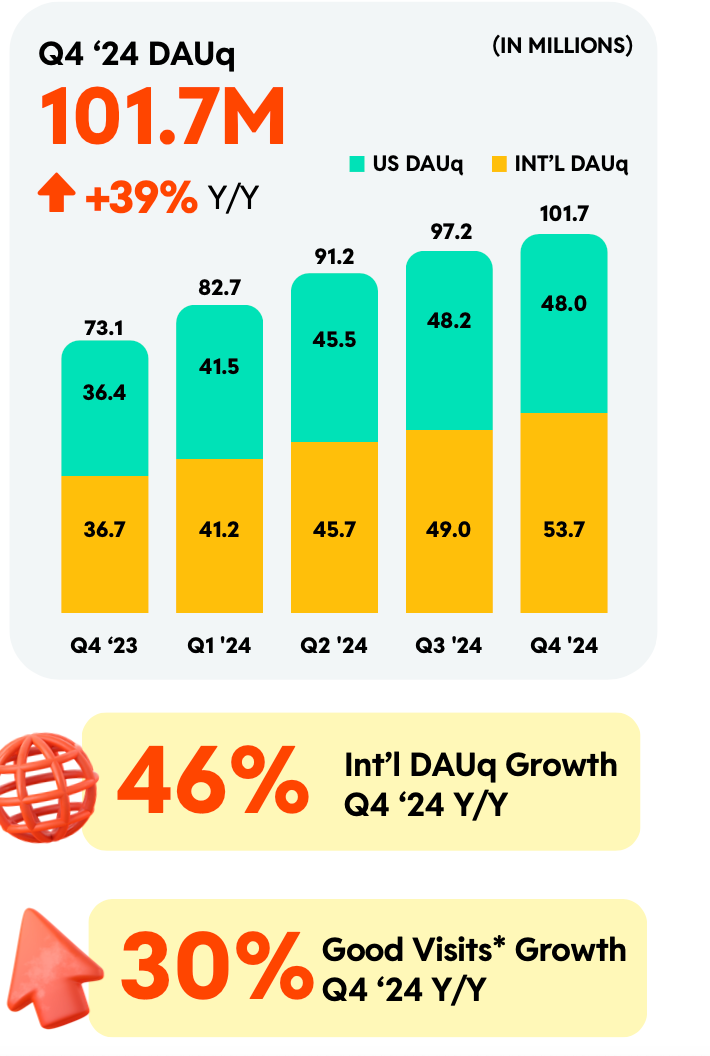

User growth remained a key highlight, with 101.7 million daily active uniques (DAUq), a 39% YoY increase. International growth outpaced domestic expansion, with international DAUq up 46% compared to the U.S. at 32%. Logged-out users grew by 51%, supporting Reddit’s position as a key destination for organic search-driven content discovery.

Advertising revenue hit $394.5 million, growing 60% YoY, with performance advertising contributing 60% of total ad revenue. Reddit expanded its ad business across geographies and industries, while Reddit Pro and AMA ads gained traction. New AI-powered initiatives like Reddit Answers, which curates search results based on community discussions, further enhanced user engagement.

Machine translation played a critical role in expanding international engagement, now available in eight languages. This contributed to strong international growth, and ARPU rose to $4.21, up 23% YoY.

Despite some volatility due to Google’s search algorithm changes, traffic recovery in Q1 2025 has been strong.

Looking ahead, Reddit forecasts Q1 2025 revenue between $360M–$370M and Adjusted EBITDA of $80M–$90M, signaling continued momentum in revenue growth and profitability.

Why The Sell-Off?

Reddit's stock has experienced a significant decline following its recent earnings report, primarily due to user growth figures that fell short of market expectations.

While the company reported strong financial performance, with a 71% year-over-year revenue increase to $427.7 million and net income of $71 million, it disclosed having 101.7 million daily active users, missing the anticipated 103 million. This shortfall in user growth led to a 19% drop in Reddit's stock during after-hours trading.

This can be attributed at least in part to the changes in Google’s search algorithm.

I Still Like Reddit

Despite the current sell-off, I am still very bullish on RDDT. Here are the four main rivers of my bull thesis.

Strong Revenue Growth and Profitability

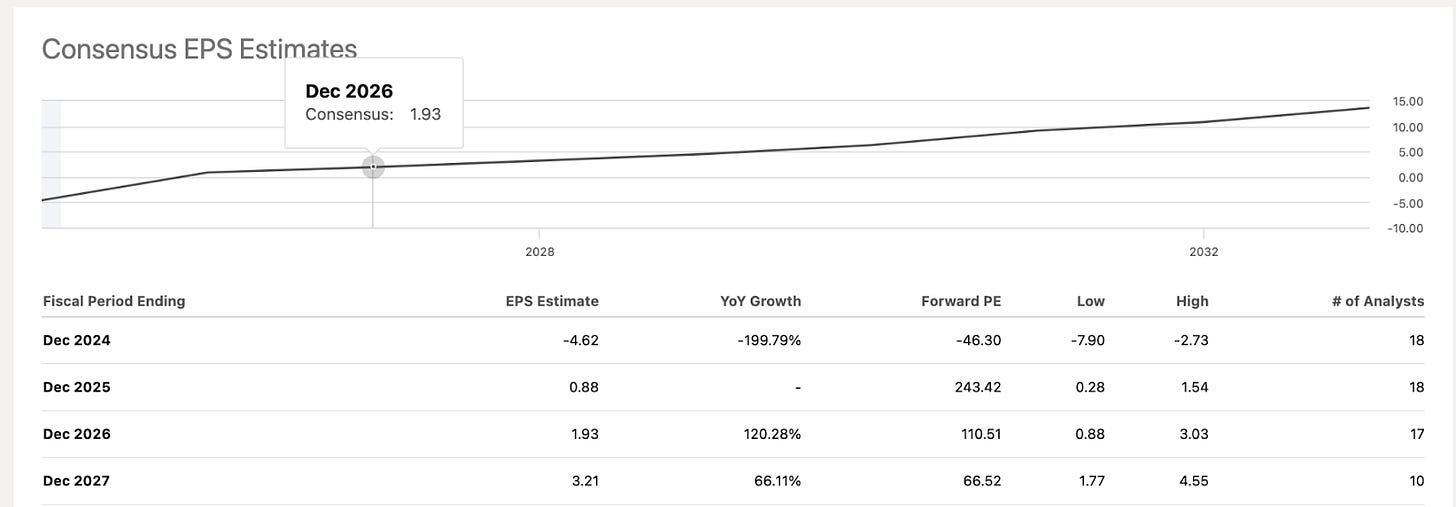

Reddit has demonstrated consistent revenue growth, with Q4 2024 revenue reaching $427.7 million, a 71% YoY increase. The company has now been GAAP profitable for two consecutive quarters, with net income of $71 million and an adjusted EBITDA margin of 36.1%. This strong financial performance, combined with increasing monetisation through advertising and data licensing, makes Reddit a compelling investmentThe company is at a key inflection point, having just turned profitable and EPS should explode higher in the next couple of years.

Expanding User Base and Engagement

Reddit’s user growth remains robust, with 101.7 million daily active uniques (DAUq), up 39% YoY. International DAUq growth outpaced the U.S. at 46% YoY, highlighting Reddit’s successful global expansion strategy. Investments in machine translation, AI-driven search (Reddit Answers), and revamped ad formats have driven deeper user engagement, further enhancing the platform’s monetisation potential.

Diversified and High-Growth Revenue Streams

Advertising remains Reddit’s primary revenue driver, growing 60% YoY to $394.5 million in Q4. Additionally, data licensing revenue surged 547% YoY, as Reddit leverages its vast content library to create high-margin revenue streams. The company’s strategy of scaling its ad business while expanding data monetisation partnerships (e.g., Intercontinental Exchange and Meltwater) positions it for long-term sustainable growth.

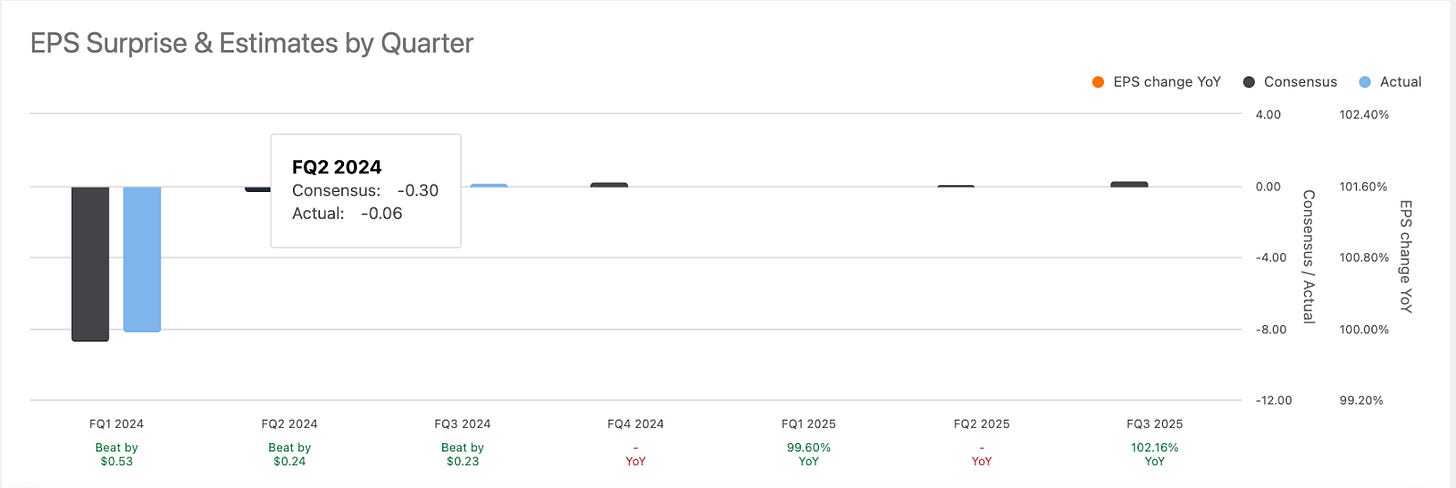

Consistently Beating Expectations & Raising Guidance

Reddit has outperformed revenue and earnings expectations for the last three quarters, with significant earnings beats driving stock price gains. With forward guidance of $360M–$370M in Q1 2025 revenue and $80M–$90M in Adjusted EBITDA, Reddit is poised to continue exceeding analyst projections. The stock has already outperformed the S&P 500 by over 17x, indicating strong investor confidence in its growth trajectory.

Is Reddit A Buy?

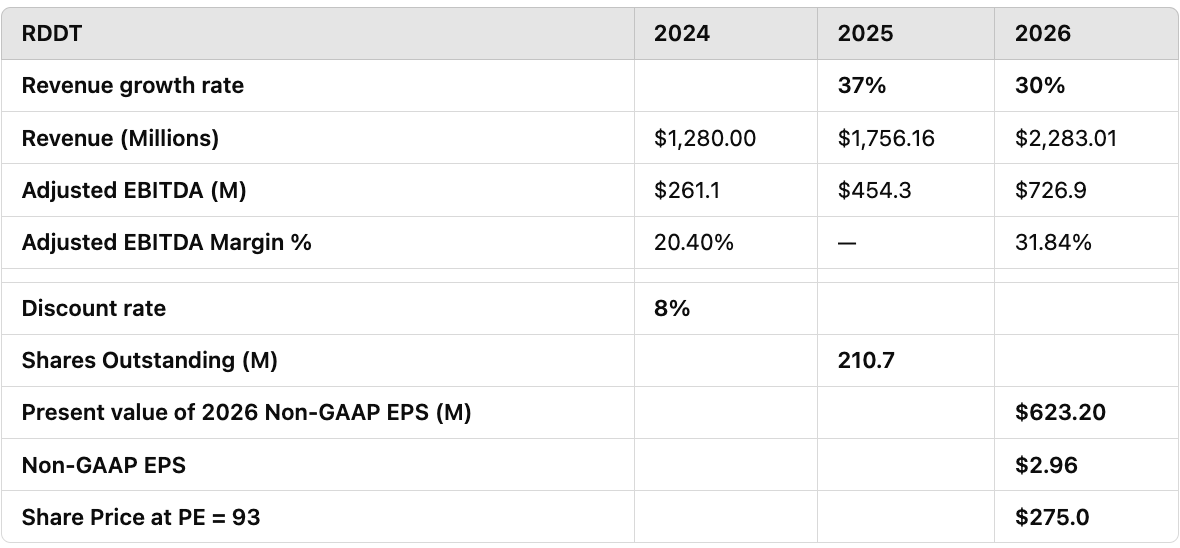

I believe this is a fantastic buying opportunity for Reddit, and the stock could still increase 50% from here based on a simple DCF model using current estimates.

I’ve assumed shares outstanding increase at a pretty fast pace, reaching over 210 million, and applied an 8% discount rate with the current 93 PE.

Risks

Reddit faces several key risks that could impact its valuation and growth trajectory. First, global liquidity conditions are tightening, with declining bank cash levels and a depleted reverse repo facility, which could reduce investor appetite for high-growth stocks. Additionally, geopolitical risks, such as escalating trade tensions with China, could dampen consumer sentiment and advertising revenue.

Final Thoughts

Reddit’s recent sell-off presents a compelling buying opportunity for long-term investors. Despite missing user growth expectations, the company continues to deliver exceptional revenue growth, expanding profitability, and innovative monetisation strategies. The platform’s international expansion, AI-driven engagement tools, and diversified revenue streams position it for sustained success.

While macroeconomic and geopolitical risks remain, Reddit’s consistent earnings beats and improving financials suggest strong future potential. With a 50% upside based on current estimates, the stock remains attractive at these levels. Investors willing to weather short-term volatility could benefit significantly as Reddit continues its growth trajectory and further monetises its vast user base.

On paper it looks good. I worry some on the political front as well. They've made themselves very woke on a lot of the site, blocking those who don't align, and I worry in today's environment that could scare away some users and make it more of an echo chamber going forward.