Potential Returns: 💰💰💰💰⚪️ (4/5)

Risk Level: 🛡️🛡️🛡️⚪️⚪️ (3/5)

Complexity: ⚪️⚪️⚪️⚪️⚪️ (0/5)

Dear Smart Investor,

Are you tired of complex, hard-to-manage portfolios that still underperform? What if I told you there's a lazier way to potentially outperform the market?

Introducing: The Super Lazy Portfolio

The most powerful portfolio might also be the simplest.

Why This Portfolio is a Game-Changer

Simplicity: Just TWO ETFs. That's it.

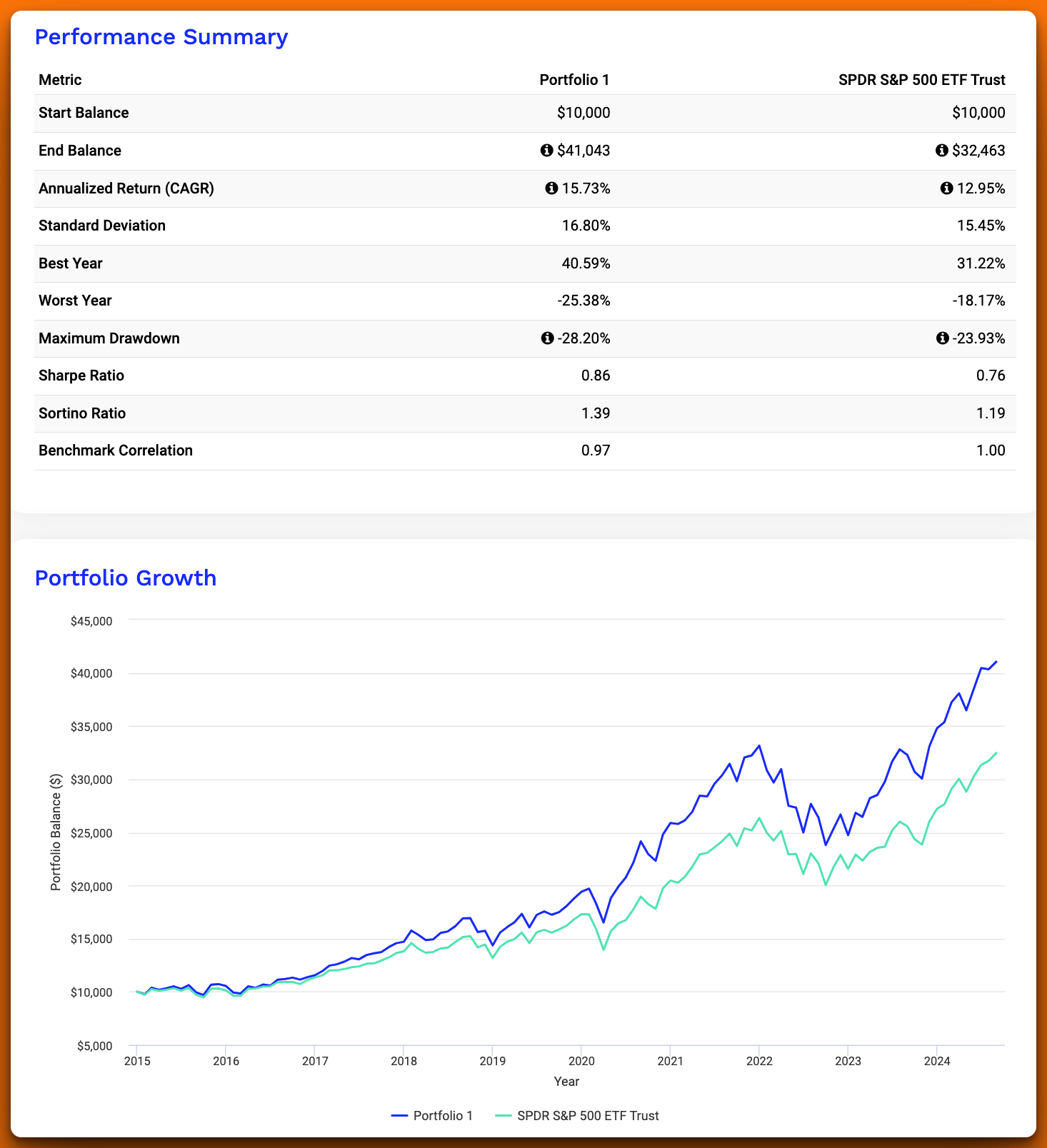

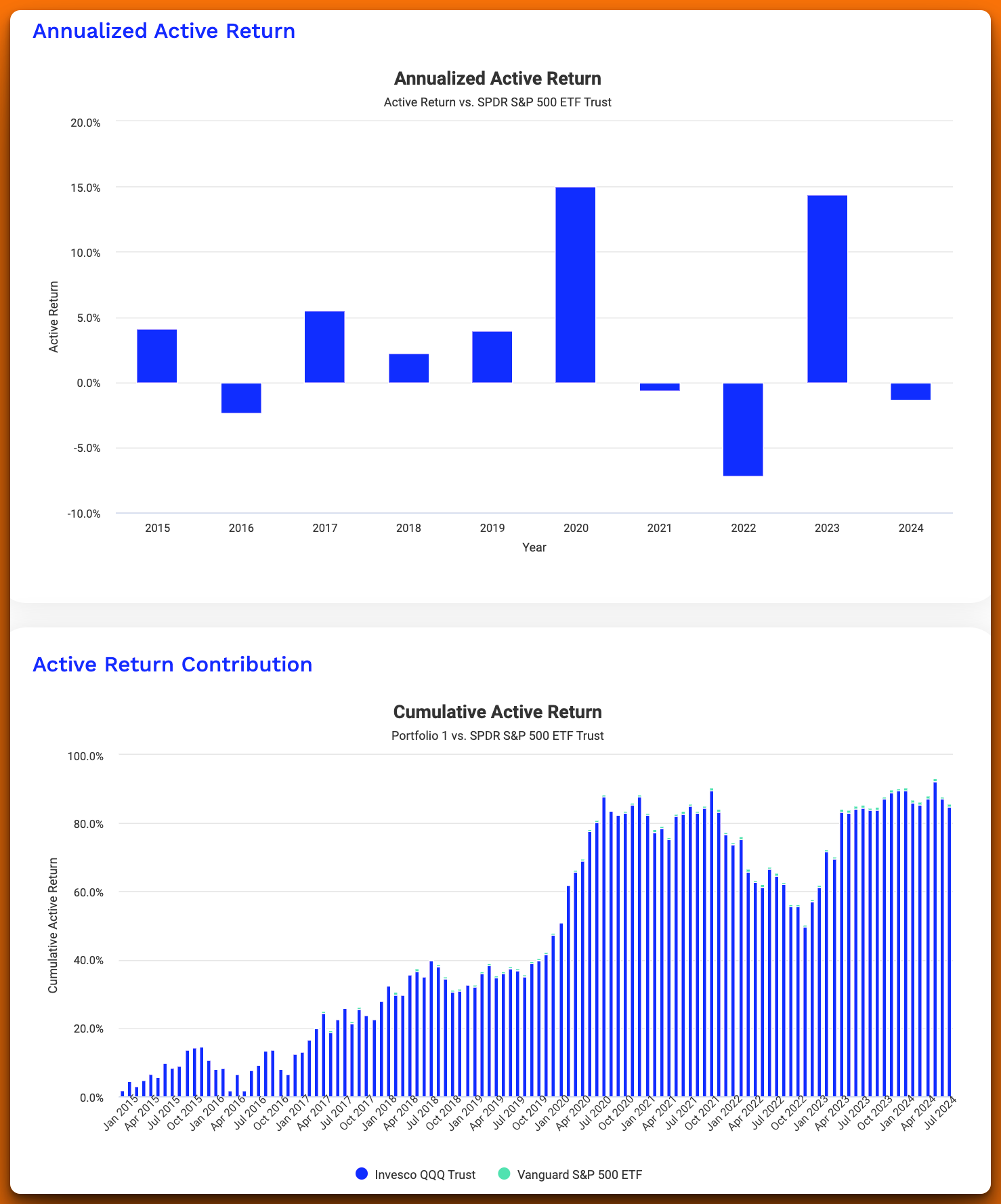

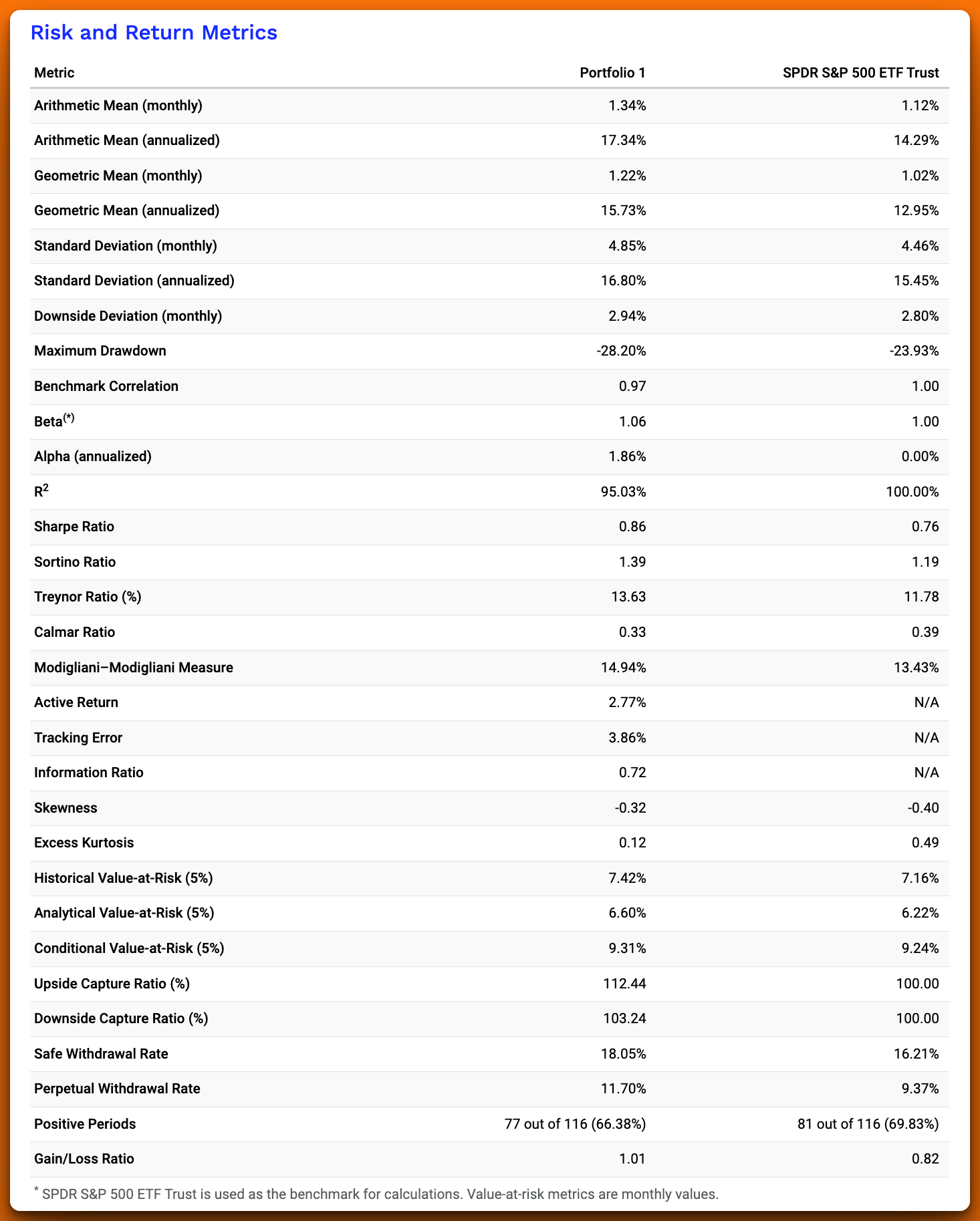

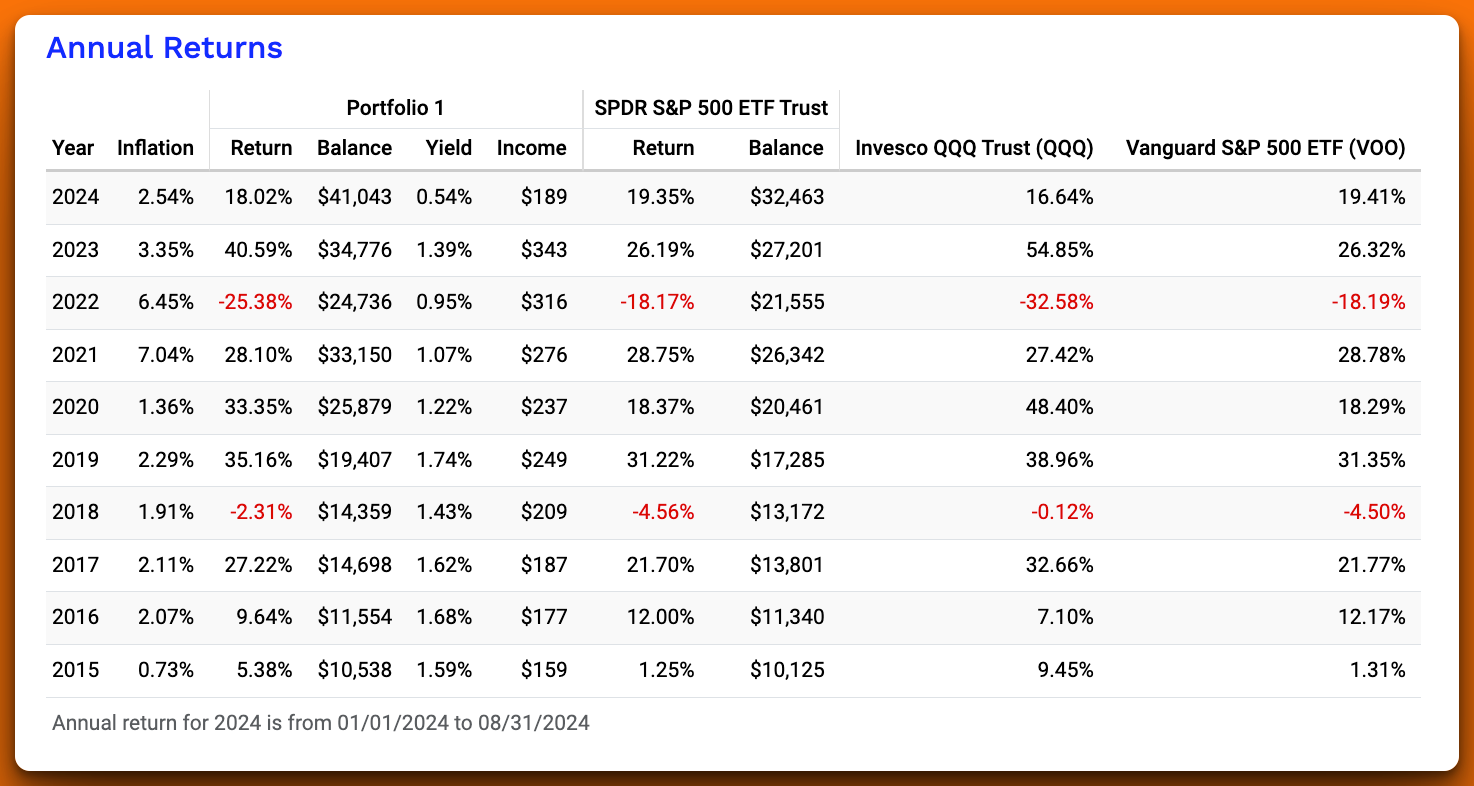

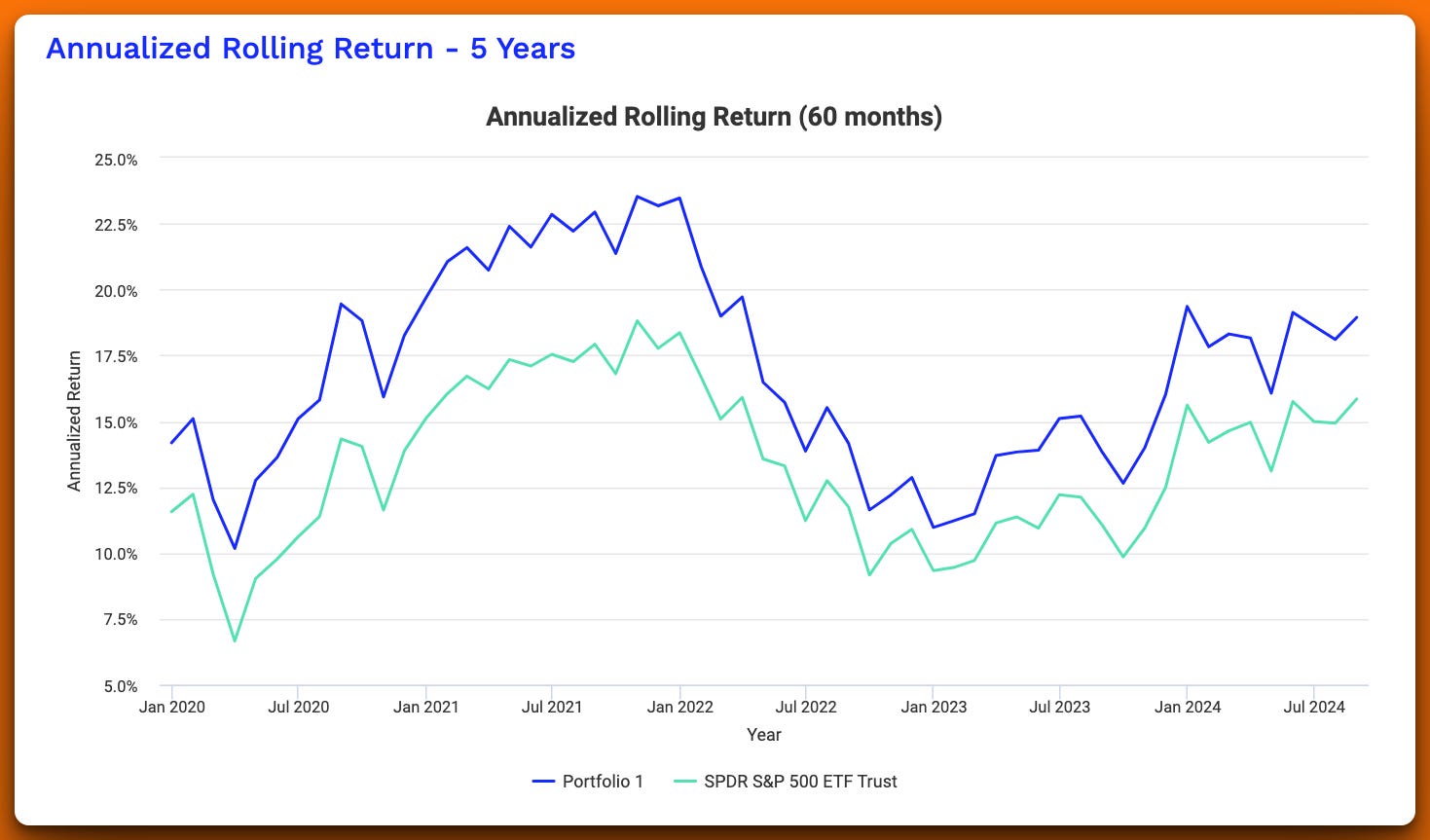

Performance: Backtested to outperform the S&P 500.

Low Maintenance: Rebalance once a year (or less).

Cost-Effective: Ultra-low fees mean more money in your pocket.

The Power of Lazy

This portfolio is so simple, you might think I'm crazy. But here's the kicker:

It has outperformed 80% of actively managed funds over the past decade.

It takes less than 5 minutes a year to manage.

It lets you sleep soundly, knowing you're invested in some of the strongest companies in the world.

Who Is This For?

Busy professionals who don't have time to watch the markets

Retirees looking for growth without the stress

New investors who want a simple, effective strategy

Anyone tired of complicated, underperforming portfolios

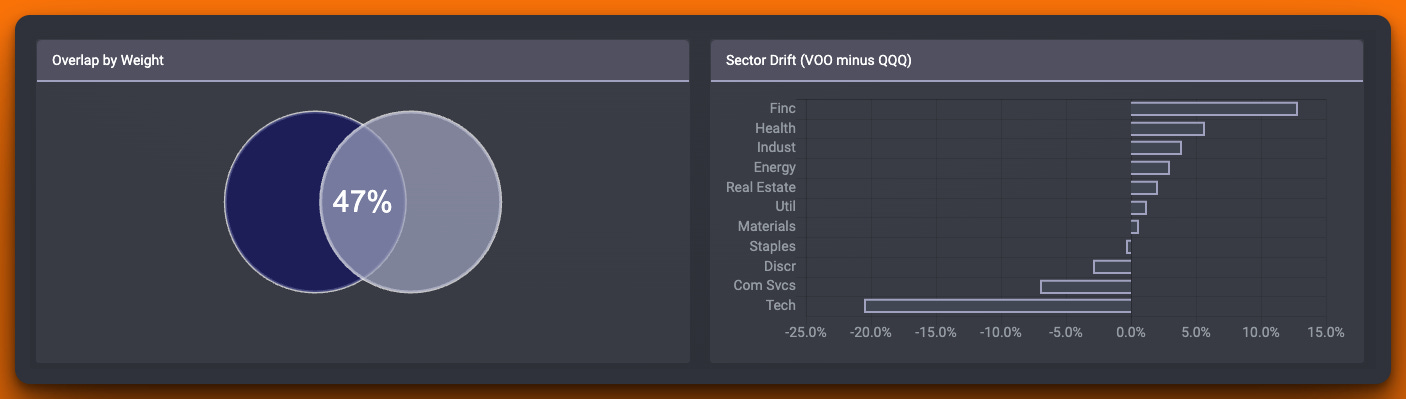

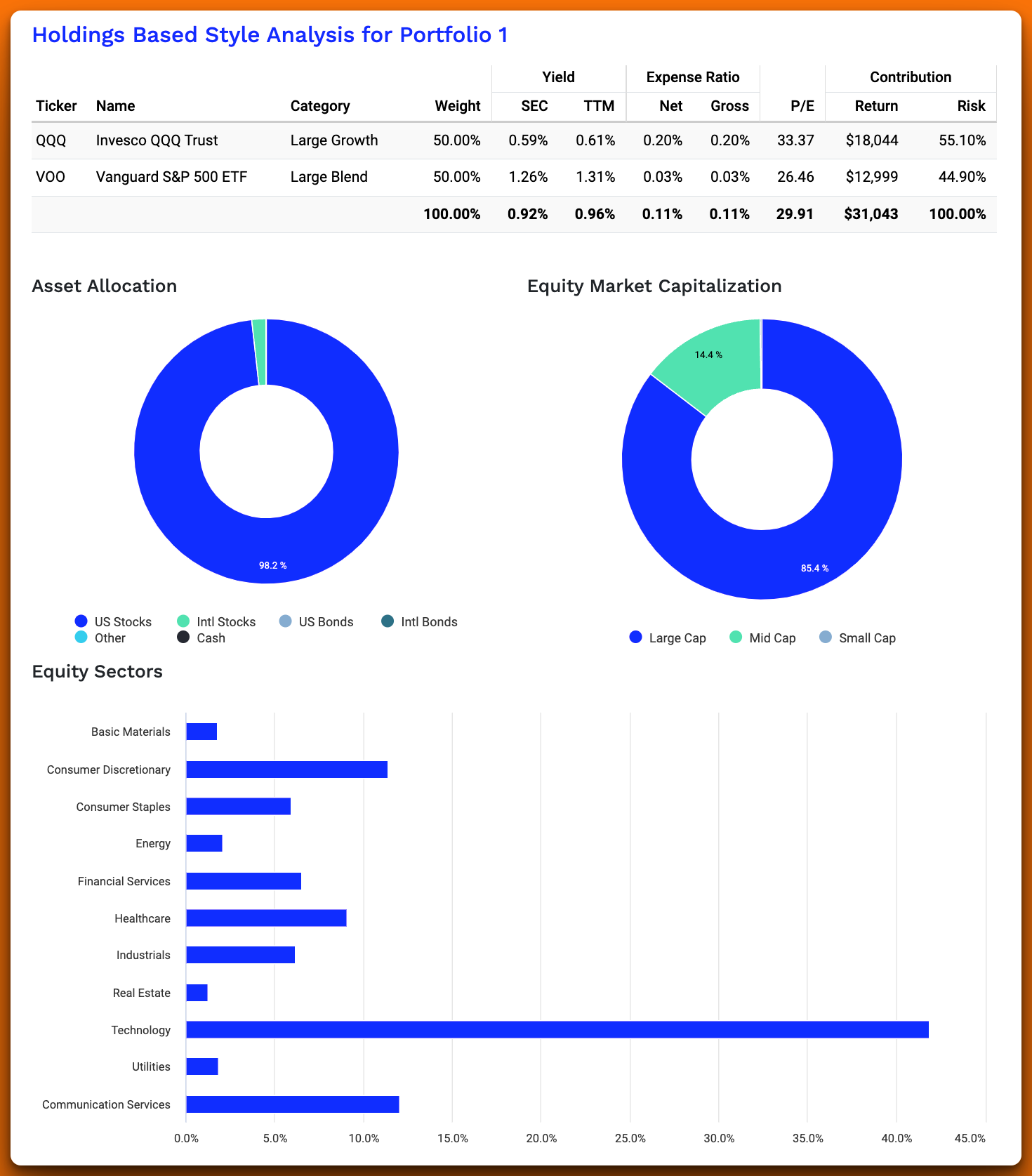

The Big Reveal: 50% VOO, 50% QQQ

That's right, the Super Lazy Portfolio consists of just two ETFs:

50% VOO (Vanguard S&P 500 ETF)

50% QQQ (Invesco QQQ Trust)

Let's break down why this combination is so powerful.

If You Like My Content Please Consider Supporting Me

Understanding the Components

VOO (Vanguard S&P 500 ETF)

What it is: VOO tracks the S&P 500 index, representing 500 of the largest U.S. companies.

Why it matters: It provides broad exposure to the U.S. stock market, including companies from various sectors.

Key benefits:

Low expense ratio (0.03%)

High liquidity

Dividend yield (typically around 1-2%)

Built-in diversification across 500 stocks

QQQ (Invesco QQQ Trust)

What it is: QQQ tracks the Nasdaq-100 Index, focusing on 100 of the largest non-financial companies listed on the Nasdaq.

Why it matters: It offers concentrated exposure to innovative, high-growth companies, particularly in technology.

Key benefits:

Exposure to tech giants like Apple, Microsoft, Amazon, and Google

Potential for higher growth

Relatively low expense ratio (0.20%)

Captures innovation across various sectors

Why This Combination Works

Balanced Exposure: VOO provides stability and broad market representation, while QQQ adds a growth kicker.

Simplicity: Just two ETFs to manage, reducing complexity and time investment.

Low Cost: Both ETFs have relatively low expense ratios, keeping more money in your pocket.

Potential for Outperformance: The growth tilt from QQQ may help the portfolio outperform the broader market over time.

Built-in Diversification: You're exposed to hundreds of companies across various sectors.

Best EU ETF Alternatives to VOO and QQQ for Tax-Efficient Investing

For European investors seeking the most tax-efficient equivalents to the Vanguard S&P 500 ETF (VOO) and the Invesco QQQ Trust (QQQ), the following ETFs offer optimal exposure to the underlying indices while maximizing tax efficiency.

S&P 500 Alternative: iShares Core S&P 500 UCITS ETF (CSPX)

Ticker Symbol: CSPX (LSE)

Domicile: Ireland

Total Expense Ratio (TER): 0.07%

Replication Method: Physical (Optimized Sampling)

Dividend Policy: Accumulating

Why CSPX is the Best Choice:

Tax Efficiency: Being domiciled in Ireland, CSPX benefits from a favorable tax treaty with the U.S., reducing withholding tax on dividends from 30% to 15%. Furthermore, as an accumulating ETF, it reinvests dividends internally, which can defer taxation on dividends in many European countries until the investment is sold, enhancing after-tax returns through compounding.

Low Costs: With a TER of 0.07%, CSPX offers one of the lowest expense ratios among S&P 500 ETFs available in Europe.

High Liquidity: CSPX is one of the most widely traded ETFs in Europe, ensuring tight bid-ask spreads and efficient trading.

Nasdaq-100 Alternative: iShares NASDAQ 100 UCITS ETF (CNDX)

Ticker Symbol: CNDX (LSE)

Domicile: Ireland

Total Expense Ratio (TER): 0.33%

Replication Method: Synthetic (Swap-Based)

Dividend Policy: Accumulating

Why CNDX is the Best Choice:

Enhanced Tax Efficiency through Synthetic Replication: CNDX uses a synthetic replication method, employing swap agreements to mimic the performance of the Nasdaq-100 index. This structure can eliminate U.S. withholding tax on dividends entirely, as the fund does not physically hold U.S. equities. The total return swap captures both price appreciation and dividend income without incurring the 15% or 30% withholding tax, potentially leading to higher net returns.

Irish Domicile Benefits: As with CSPX, the Irish domicile provides regulatory stability and investor protection under UCITS regulations.

Accumulating Structure: The ETF reinvests all income internally, which can defer taxation on dividends, optimizing compounding growth.

I'm tossing 100k in each during the next severe market downturn. Not touching for 30 yrs. About to test the "Keep it simple, Stupid" methodology in the investing world.

Love the simplicity of the The Super Lazy Portfolio. The effort required to maintain this portfolio justifies the name, but the returns are not at all "lazy."

Sorry if I didn't catch the info, but how often should one rebalance to 50% each ETF in the portfolio?