Potential Returns: 💰💰💰💰💰 (5/5)

Risk Level: 🛡️🛡️🛡️⚪️⚪️ (3/5)

Complexity: ⚪️⚪️⚪️⚪️⚪️ (0/5)

Are You Ready for the Market's Next Possible Big Shift?

The past decade has been a golden era for tech investors. The NASDAQ has soared, driven by the relentless growth of tech titans like Apple, Amazon, Microsoft, and the meteoric rise of AI-focused companies like NVIDIA. Growth ETFs like QQQ have been the go-to vehicles, delivering staggering returns and making millionaires out of early adopters.

But every party has an end.

Economic indicators are flashing warning signs:

Overvalued Tech Stocks: P/E ratios are at historical highs.

Economic Slowdown: Global growth is decelerating.

Rising Debt Levels: Consumer and corporate debt are reaching unsustainable levels.

Interest Rate Cuts: The Federal Reserve's aggressive rate cuts signal potential trouble ahead.

Remember the dot-com bubble of the early 2000s? Tech stocks were the darlings until they weren't. When the bubble burst, it wiped out $5 trillion in market value between 2000 and 2002.

What if we're on the verge of another tech meltdown?

If your portfolio is heavily weighted in tech and growth stocks, you could be vulnerable. But what if there was a way to not only protect your investments but also continue growing your wealth—even if the tech sector collapses?

Today, I'm unveiling my Secret 3-ETF Portfolio designed to shield your wealth from a potential tech bust while still capturing solid returns. This is a strategic move to outpace the market regardless of where it's headed.

Why This Portfolio Is Your Financial Lifeboat

1. Anticipate the Tech Reckoning

Tech stocks have enjoyed an unprecedented bull run, but gravity is inevitable. The excessive valuations and speculative investments in AI and tech signal a bubble that's ripe for bursting. By adjusting your portfolio now, you're strategically positioning yourself ahead of the curve.

2. Capitalize on Value Stocks' Resilience

Historically, value stocks outperform during bear markets and economic recessions. Companies with strong fundamentals, consistent dividends, and solid balance sheets offer stability when markets turn volatile. This portfolio leans into that resilience.

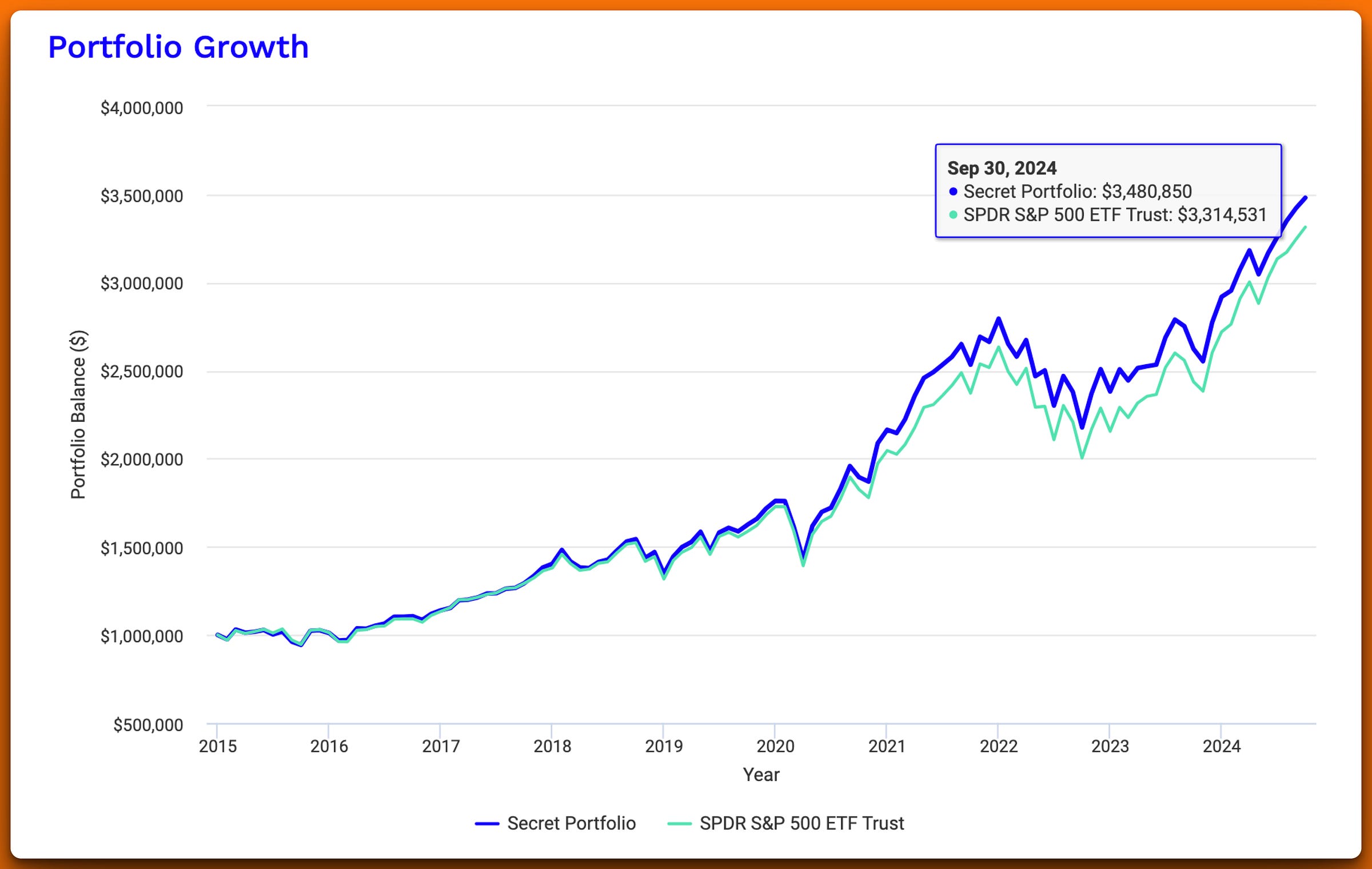

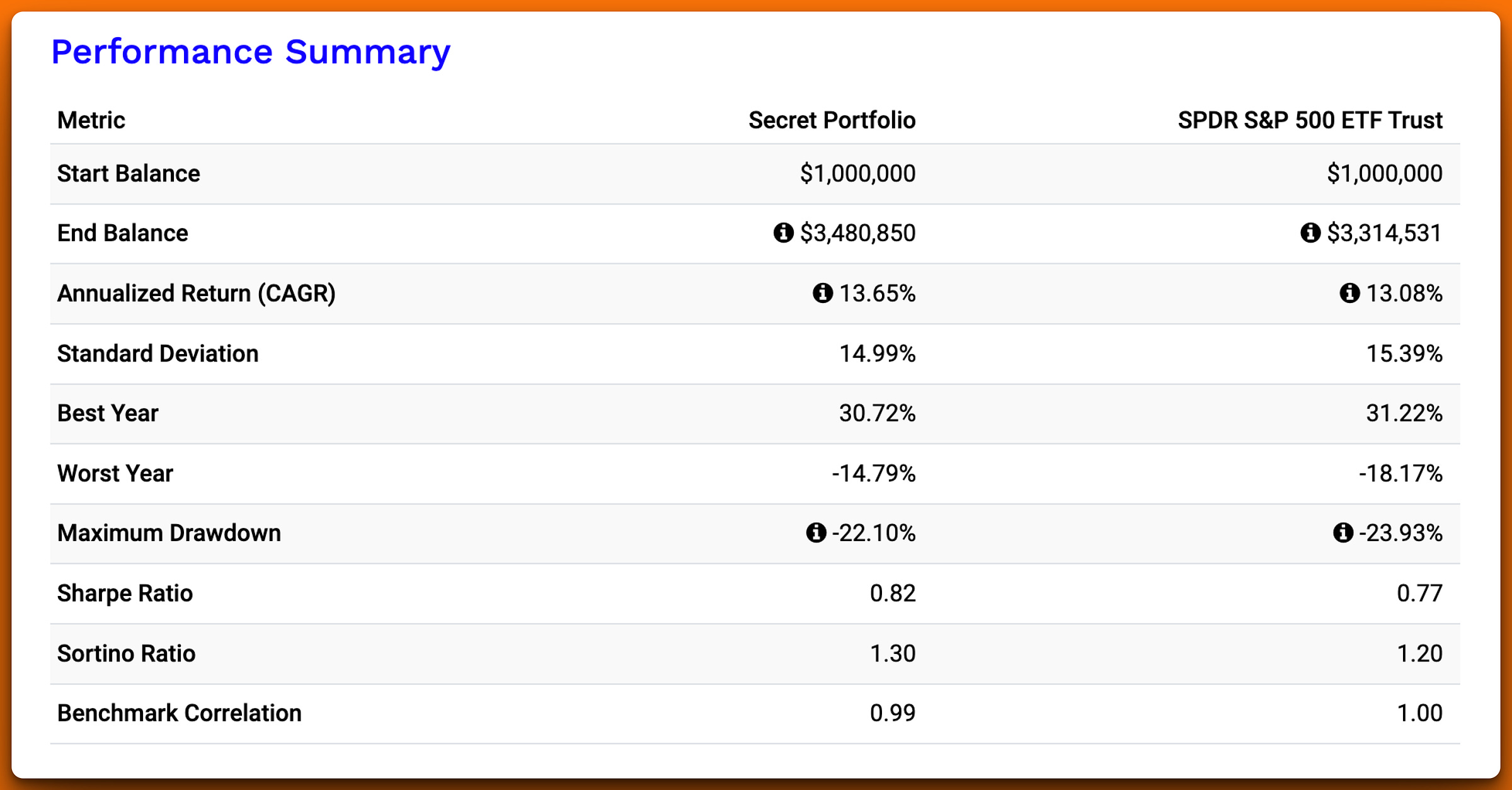

3. Superior Historical Performance

From January 2015 to September 2024, this portfolio outperformed the S&P 500:

End Balance: $3,480,850 vs. $3,314,531

Annualized Return (CAGR): 13.65% vs. 13.08%

Lower Volatility: Standard Deviation of 14.99% vs. 15.39%

Better Risk-Adjusted Returns: Sharpe Ratio of 0.82 vs. 0.77

4. Reduced Risk Without Sacrificing Returns

Maximum Drawdown: -22.10% vs. -23.93% for the S&P 500

Beta: 0.97, indicating less sensitivity to market swings

Alpha: 0.90%, showcasing the portfolio's ability to generate excess returns independent of the market

5. Diversification Across Styles and Sectors

By combining dividend-paying value stocks, growth stocks, and a broad market ETF, this portfolio minimizes sector-specific risks and reduces overexposure to any single market segment.

While most investors are overleveraged in tech-heavy portfolios like QQQ and VOO, this secret portfolio positions you to come out ahead.

The Unveiled Strategy: Bulletproof Your Portfolio with These 3 ETFs:

Keep reading with a 7-day free trial

Subscribe to The Stock Insider to keep reading this post and get 7 days of free access to the full post archives.