Potential Returns: 💰💰💰💰💰💰💰💰💰💰 (10/5)

Risk Level: 🛡️🛡️🛡️🛡️🛡️ (5/5)

Complexity: ⚪️⚪️⚪️⚪️⚪️ (0/5)

Today, I’m presenting a 3-ETF Crypto Portfolio designed for investors who are comfortable with risk in exchange for the possibility of outsized returns. This strategy isn’t for everyone, but if you're prepared to ride the ups and downs of the digital revolution, this might be your golden ticket.

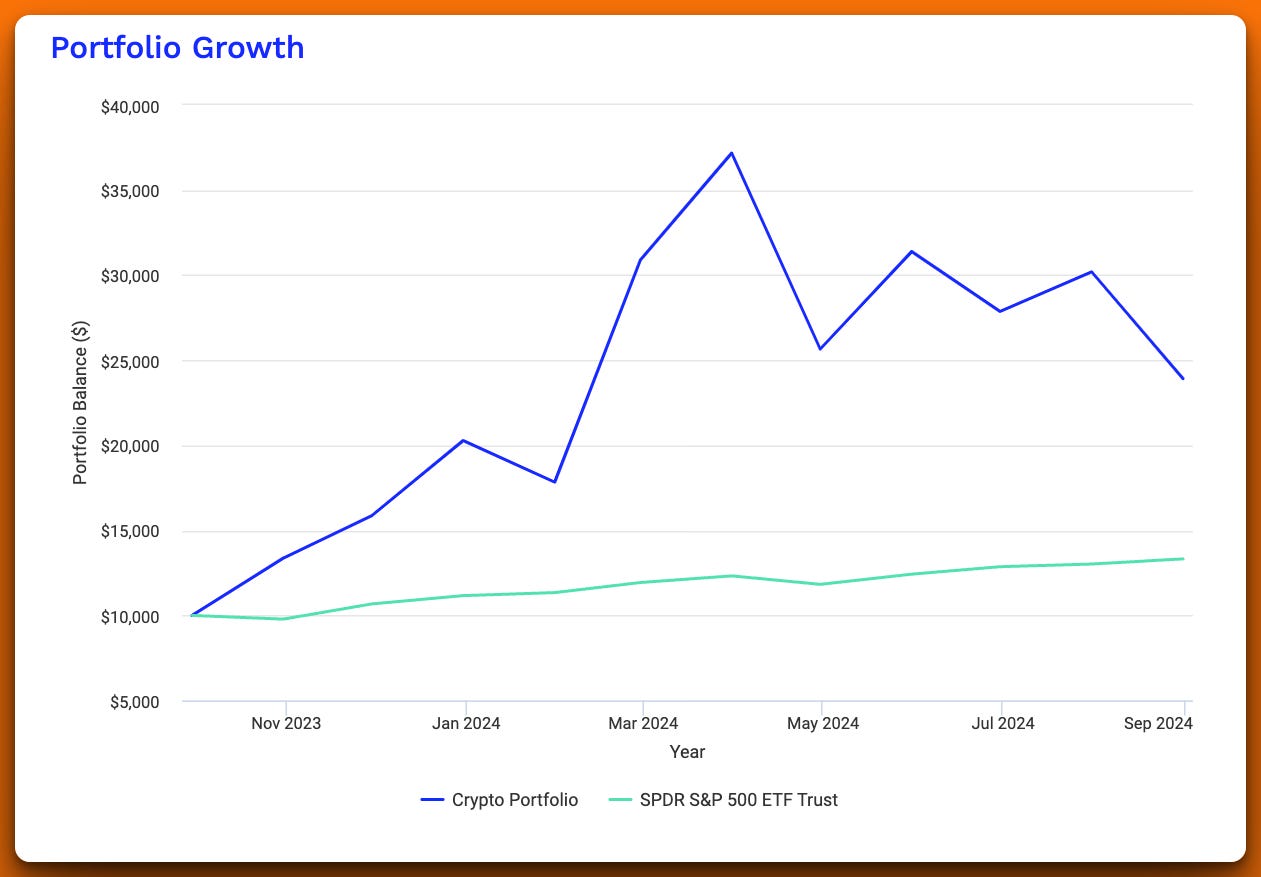

This portfolio has shown a 139.08% return, crushing the 33.24% returned by the S&P 500 over the same period.

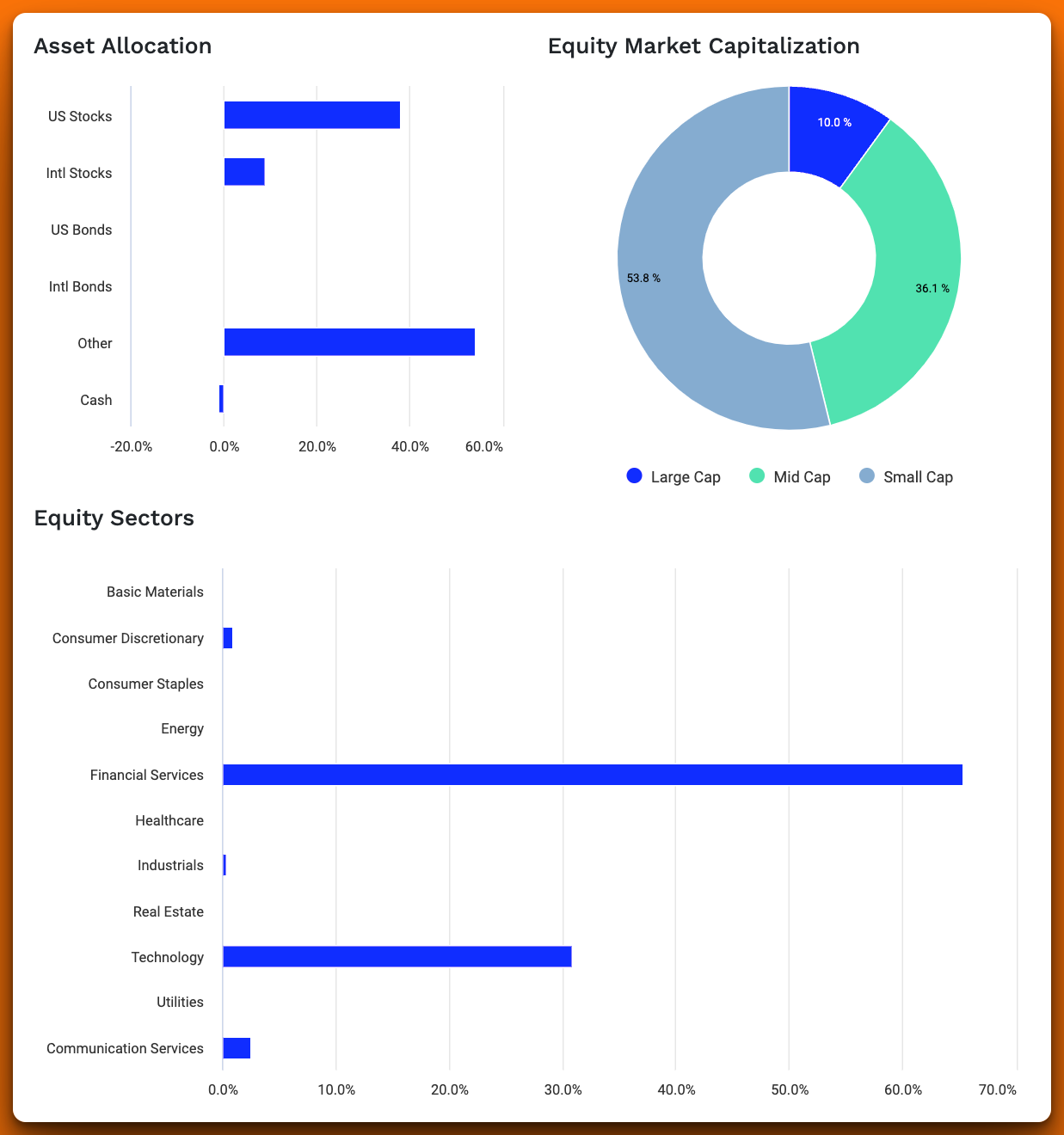

It’s not about buying Bitcoin and calling it a day. We’re using ETFs that give you leveraged exposure to Bitcoin itself and diversified access to crypto-related companies, blockchain innovators, and the digital economy. It’s about maximizing returns while managing risk through strategic diversification.

Why This Portfolio Matters

1. Exponential Growth Potential

This 3-ETF portfolio taps directly into the core of the crypto and blockchain revolution. The returns we've seen are nothing short of staggering. With a start balance of $10,000, the portfolio grew to $23,908, more than doubling your initial investment. By comparison, the same $10,000 in the S&P 500 would be worth just $13,324. If you've ever needed a reason to diversify away from traditional assets, this is it.

Key Performance Stats:

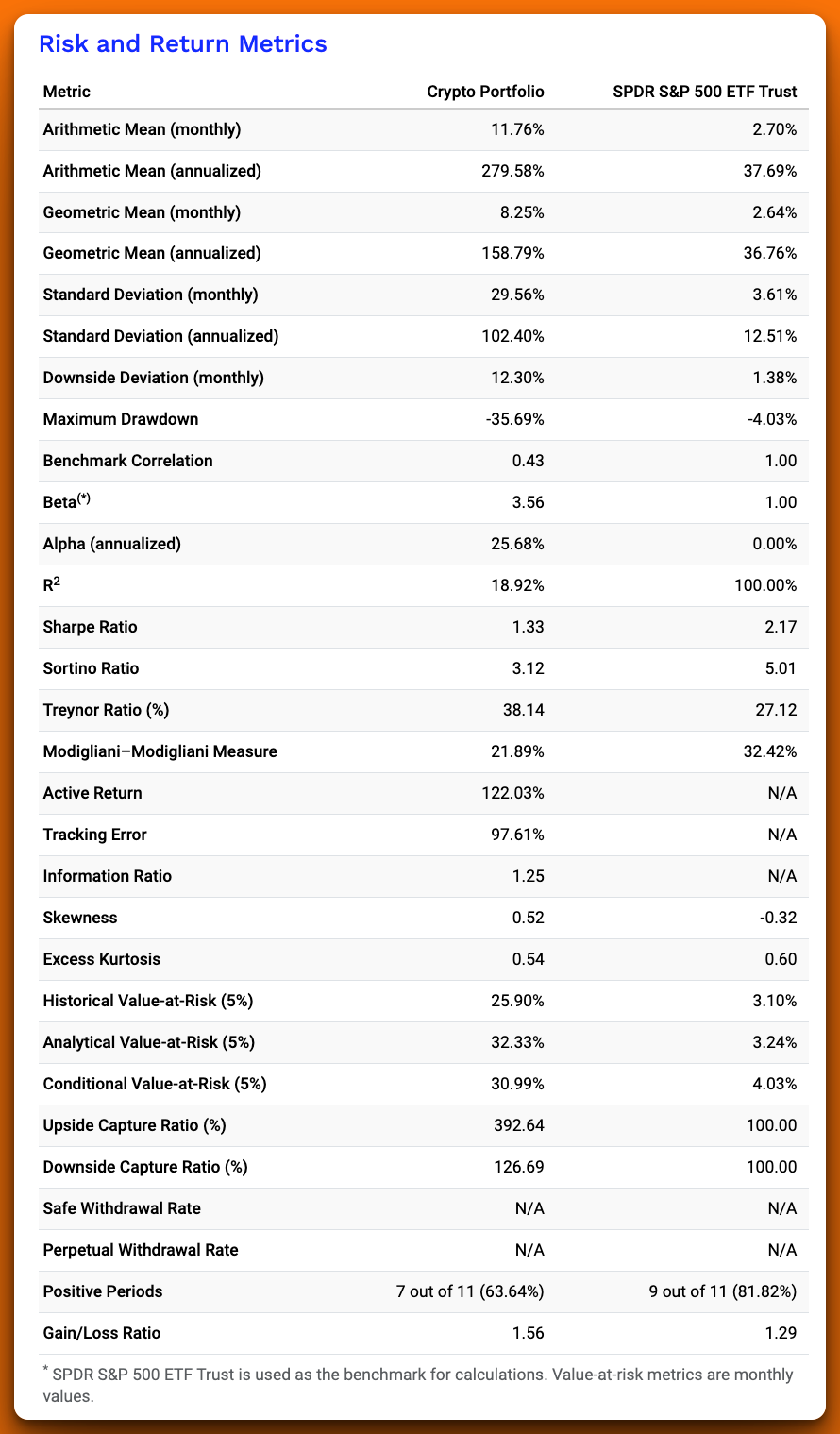

Annualized Return: 279.58% (crypto portfolio) vs. 37.69% (S&P 500)

Sharpe Ratio: 1.33 (crypto portfolio) vs. 2.17 (S&P 500)

2. Leveraged Exposure

The first ETF in this portfolio leverages Bitcoin by 2x, meaning that if Bitcoin goes up 10%, you’re looking at 20% returns. However, if Bitcoin takes a hit, you’ll also feel that pain multiplied. This is a double-edged sword, but for high-conviction investors, the upside potential is immense.

3. Diversification in the Crypto Space

This portfolio doesn’t just ride on Bitcoin’s coattails. It invests in a broad array of crypto-related companies, blockchain innovators, and digital economy enablers. This adds an element of diversification that many crypto portfolios lack. The ETFs in this portfolio have only a 7% overlap, ensuring that your exposure to different corners of the crypto economy is maximized.

Why You Should Pay Attention

Massive Gains—And Risks

We won’t sugarcoat it—this portfolio is volatile. The standard deviation is a whopping 102.40% compared to 12.51% for the S&P 500. You could see a 35.69% drawdown during the worst stretches, so if you can’t stomach that kind of volatility, this might not be the right strategy for you. But the potential upside is where this portfolio shines. In good years, the returns are nothing short of astronomical—this portfolio’s best year saw a return of 102.79%.

Risk Metrics and Performance

Maximum Drawdown: -35.69% (Crypto Portfolio) vs. -4.03% (S&P 500)

Sharpe Ratio: 1.33 (Crypto Portfolio) vs. 2.17 (S&P 500)

Sortino Ratio: 3.12 (Crypto Portfolio) vs. 5.01 (S&P 500)

Beta: 3.56 (Crypto Portfolio) – your exposure to market volatility is high, but so is the opportunity.

While the S&P 500 offers a smooth, reliable ride, the crypto portfolio delivers adrenaline-pumping gains that will appeal to those with high risk tolerance.

A Closer Look at the Numbers

If you’re someone who likes data, let’s dive deeper into the metrics that matter most:

Geometric Mean (annualized): 158.79% (crypto portfolio) vs. 36.76% (S&P 500)

Maximum Drawdown: -35.69% (crypto) vs. -4.03% (S&P 500)

Upside Capture Ratio: 392.64% – When the market surges, this portfolio multiplies the gains.

Downside Capture Ratio: 126.69% – Yes, you’ll feel the downturns, but the upside is often worth it.

Now imagine you had invested $1 million a year ago. Today, you’d be sitting on $2.39 million. That’s the power of this crypto portfolio. Meanwhile, the same $1 million in the S&P 500 would only have grown to $1.33 million.

The returns are undeniable.

The Crypto Enthusiast’s Portfolio: Designed for Maximum Returns

Here’s a brief overview of what the portfolio offers before we dive into the ETF specifics:

High-Risk, High-Reward: Expect dramatic swings in your portfolio’s value, but also the potential for life-changing gains.

Diversified Exposure: The combination of crypto assets and blockchain-related companies minimizes over-concentration in any single area.

Designed for Crypto Believers: If you’ve got faith in the future of blockchain, this portfolio is structured to reward your conviction.

Now, let’s get into how this all comes together.

The Big Reveal: The 3-ETF Crypto

Keep reading with a 7-day free trial

Subscribe to The Stock Insider to keep reading this post and get 7 days of free access to the full post archives.