The Monopoly Illusion: Why ‘Natural’ Really Means ‘Politically Manufactured’

Decode the red tape that boosts select giants, kneecaps competitors, and lines investors’ pockets.

Welcome to 🧙♂️ The Hermit 🧙♂️, your gateway to uncovering investment insights you won’t find anywhere else. With a sharp focus on microcaps, unique strategies, and transparent updates on a real seven-figure portfolio, it’s perfect for investors who value depth over noise.

Each post distills hours of meticulous research into actionable ideas, portfolio reviews, and thought-provoking analysis - all delivered with clarity, wit, and a touch of humor. Whether you’re a seasoned investor or just curious about smarter strategies, The Hermit offers a fresh perspective that’s both insightful and entertaining.

Subscribe today and join a community that’s redefining investment thinking. 🧙♂️📈

Natural Monopolies

When you study economics, you're introduced to this mythical creature called a "natural monopoly." People who’ve read a lot of books (or at least claim to) will tell you it’s something like railroads, the postal service, or your local telecom fiber network.

According to Investopedia, a natural monopoly is “a type of monopoly in an industry or sector with high barriers to entry and start-up costs that prevent any rivals from competing”.

Maybe I’m the odd one out here, but I see a flaw in this logic. Sure, all the usual examples have massive barriers to entry and startup costs, but that’s only because they require a license.

So, you're basically saying natural monopolies are just government-created artificial monopolies?

Well, yes... and no.

Here’s the thing: depending on the scope, all the examples I mentioned can be monopolies in their own right.

Let me give you an example: imagine a butcher shop in a town of 20 people. The butcher sells meat to about half of them every other day, just enough to cover his salary and the shop’s fixed costs. Technically, the butcher is a monopoly aka the only meat supplier around. And it’s "natural" because no one else wants to compete with a business that’s barely breaking even.

Now, imagine the Bob the butcher suddenly decides to double his prices.

What happens next?

People who want meat don’t really have a choice, so they pay up. Sure, maybe instead of 10 customers, he’s down to 9, but now he’s making double the profit.

Suddenly, he’s covering his salary, shop costs, and has some extra cash for a rainy day - or, you know, his next Ferrari.

The butcher feels on top of the world, but he has lost his status as a "natural monopoly" without even realizing it.

Why? You might ask.

Well, that extra profit just caught the attention of a competitor from the next town over, who sets up shop right next door. And just like that, the monopoly turns into a duopoly.

The Real Deal

Take a railroad, for example. Sure, it might initially not make economic sense for anyone else to jump in. But eventually, when demand and prices get high enough, a competitor might decide it’s worth building some extra tracks to cash in on the busy routes.

Why doesn’t that happen?

Well, there's this entity that somehow thinks it knows better than basic economics about what people should or shouldn't do. And, of course, that comes with a cost. That cost? You, the consumer. By keeping out new competition, these so-called "natural monopolies" get fat, lazy, and - given enough time - pretty authoritarian.

Eventually, it will lead to a steady state where the answer to critics is something along the lines of:

“If you don’t like the price of this train, well, you can just f**k right off.”

In summary, natural monopolies are often described as industries with high barriers to entry, but they exist largely because of government-issued licenses that keep competitors out. Over time, this lack of competition makes these monopolies inefficient, leaving consumers with no choice but to accept inflated prices and poor service.

Real-World Examples of Natural Monopolies

While none of these companies are free from competition, they are the clear leaders in their industries. In his lecture "Competition is for Losers," Peter Thiel explains the essential factors that allow such companies to thrive. I won’t spoil it for you; here’s the link to the lecture.

In the meantime, here are some examples of true natural monopolies. You’ll notice a common theme: these companies consistently deliver superior services at lower prices, making them the natural choice for consumers.

The Search Function: Google (Alphabet Inc.) dominates the search engine market with a global market share of over 90%. Entrants would struggle to replicate Google's data collection and optimization scale.

As of recent estimates, Google handles over 20 petabytes of data every day. To put that into perspective, 1 petabyte equals 1,024 terabytes, or 1 million gigabytes. This includes data from its search engine queries, YouTube video views, Gmail, Google Maps, Google Ads, and countless other services.

The Low-Cost Oil Giant: Saudi Aramco controls a significant portion of the world’s proven oil reserves (~17%) and has established a powerful infrastructure for exploration, extraction, and refining.

Competing in this industry requires huge amounts of capital, and getting regulatory access to reserves is no easy task. Aramco has a big edge here, producing oil at just $3 to $5 per barrel, while offshore, shale, and oil sands producers (basically the rest of the world) face costs between $30 and $60 per barrel.

THE Beverage brand: Coca-Cola's global distribution network, brand strength, and deeply ingrained customer loyalty create formidable barriers. According to Forbes' rankings, as of 2023, the company's brand is valued at around $64 billion.

Coca-Cola is the #1 most recognizable brand in over 80 countries, including major markets like the U.S., Mexico, and Japan. It's extremely hard for new entrants to replicate the marketing power and distribution partnerships.

Close Up Visa’s ‘Monopoly’

The Payments Toll Bridge: Visa's global payment network is woven into the fabric of banks, businesses, and everyday consumers. With its massive infrastructure and the trust it's built over the years, it's tough for any newcomers to break in. The secure systems and strong connections Visa has created make it hard for anyone else to compete on that level.

Back in the late '50s, credit cards were a pretty new concept, and Bank of America spotted a chance to offer something different - a flexible way for people to pay and a dependable credit option for businesses. The idea behind the BankAmericard was a game-changer. It let people use the same card at different places, and even better, it introduced revolving credit, so cardholders could carry a balance and pay it off over time.

Visa's story began in 1958 when Bank of America launched the BankAmericard in Fresno, California, the first mass-marketed credit card. The card quickly became popular, and by 1966, Bank of America began letting other banks across the U.S. offer their own versions of the card. In 1970, to ensure a smooth operation, Bank of America established National BankAmericard, Inc. (NBI), making sure all the banks followed the same rules to ensure a consistent experience for both customers and businesses.

In 1976, BankAmericard got a new name: Visa, chosen because it was simple, catchy, and had a ‘global vibe’ - like a passport for payments across borders. This rebrand set Visa up for global expansion, as banks around the world started offering it, making Visa the go-to for secure, cross-border transactions. By 1977, Visa International was created to manage its fast-growing global network, bringing everything under one brand. Around the same time, Visa was also driving tech innovations, like launching its first electronic authorization system in 1973, which transformed how transactions were processed and improved fraud prevention.

Visa hit a major milestone in 2008 when it went public in one of the biggest IPOs in U.S. history, raising $17.3 billion (after all expenses). This move turned Visa from a bank cooperative into a centralized public company.

Today Visa is a toll bridge between consumers and merchants who want to perform a transaction minimizing frictional costs and securing these through the banking sector. Visa operates in +200 countries and processes billions of transactions every year.

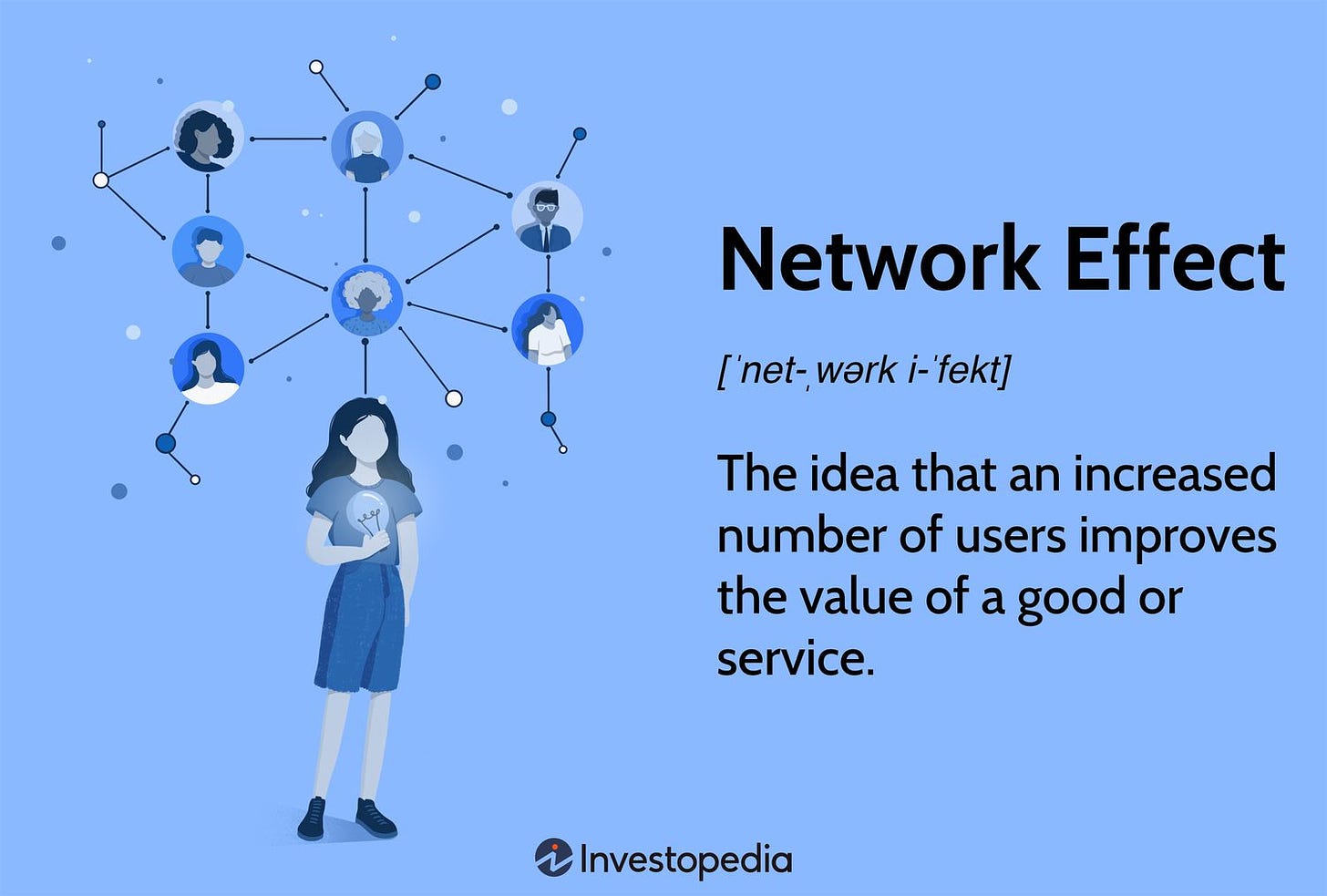

Visa's competitive advantage lies primarily in its massive global scale, network effects, and trusted brand. Its brand alone is ranked #18 worldwide and valued by Forbes at $31.8 billion. As the largest card payment network, Visa processes over $12.3 trillion in payments annually, connecting 2.9 billion cards to 130+ million merchants worldwide. This vast network fosters powerful two-sided network effects: more consumers using Visa cards attract more merchants, further incentivizing consumers to use the cards.

VisaNet and its technological infrastructure, can handle up to 76,000 transactions per second, providing unparalleled speed, reliability, and security. Visa's advanced fraud prevention systems ensure a high level of trust among users, helping to reduce fraud rates and increase consumer confidence.

Additionally, Visa's business model benefits from high operating leverage due to its capital-light nature. The company doesn't take on credit risk and enjoys a high-profit margin (66.4% average 5-yr EBIT). You may think this would attract competition, but barriers to entry are huge (especially network effects).

Strategic partnerships with fintech companies, acquisitions, and investments in digital payment innovations such as contactless (fairly impactful during COVID) and cryptocurrency payments strengthen its ecosystem. Visa is also expanding into business-to-business payments, targeting a multi-trillion-dollar market, and sees growth potential in emerging markets where digital payment adoption is rising. These factors create significant barriers to entry, cementing Visa's dominance in the global payments industry.