[Jack’s note] Shoutout to my buddy, James, The Pragmatic Investor, and thanks for this article!

TL;DR

2024 was a banner year for stocks, but what about 2025?

With so many stocks trading at all-time highs, it can seem hard to find good opportunities in the market right now.

However, after thorough research, I have identified three interesting opportunities that could potentially supercharge your portfolio returns.

We will be covering three stocks today:

A profitable large-cap tech stock that has just established a partnership with NVIDIA but is trading at under 1 forward PEG

A “quantum computing/AI” stock that has been around for years and actually pays a dividend

A Chinese fintech stock that actually tallied in 2024. Imagine what it can do if the country begins to recover.

But first, a little bit about me, The Pragmatic Investor

An approach that assesses the truth of meaning of theories or beliefs in terms of the success of their practical application.

That is Pragmatism, and it guides my investment philosophy.

Through many years of analyzing markets, I have found this is what works.

The Pragmatic Investor sticks to what works. The problem is that thousands of different strategies can work for certain people.

However, simplicity is key, which is why I have narrowed my investing ethos down into three key ideas. Together, these ideas create what I like to call The Pragmatic Investing Pyramid.

Macro, Fundamentals, and Technical.

This three-pronged approach has helped me beat markets over the seven years.

For long-term investing, there’s nothing better than understanding business cycles, macroeconomic trends and geopolitics.

On the other hand, technical analysis is the best tool for predicting short-term market moves.

And not just a specific form of technical analysis but a robust set of tools that can all work together to help us find great setups.

I actually recently designed my own algorithm. You can see it here:

My Substack is designed to guide investors of all levels in their journey.

Understand markets with the weekly newsletter.

Build a diversified global portfolio that will stand the test of time.

Get actionable trade ideas to take your investment returns to the next level.

Every week, I provide a macro update and technical analysis on the main indexes and stocks. I also cover a stock in depth, examining its fundamentals.

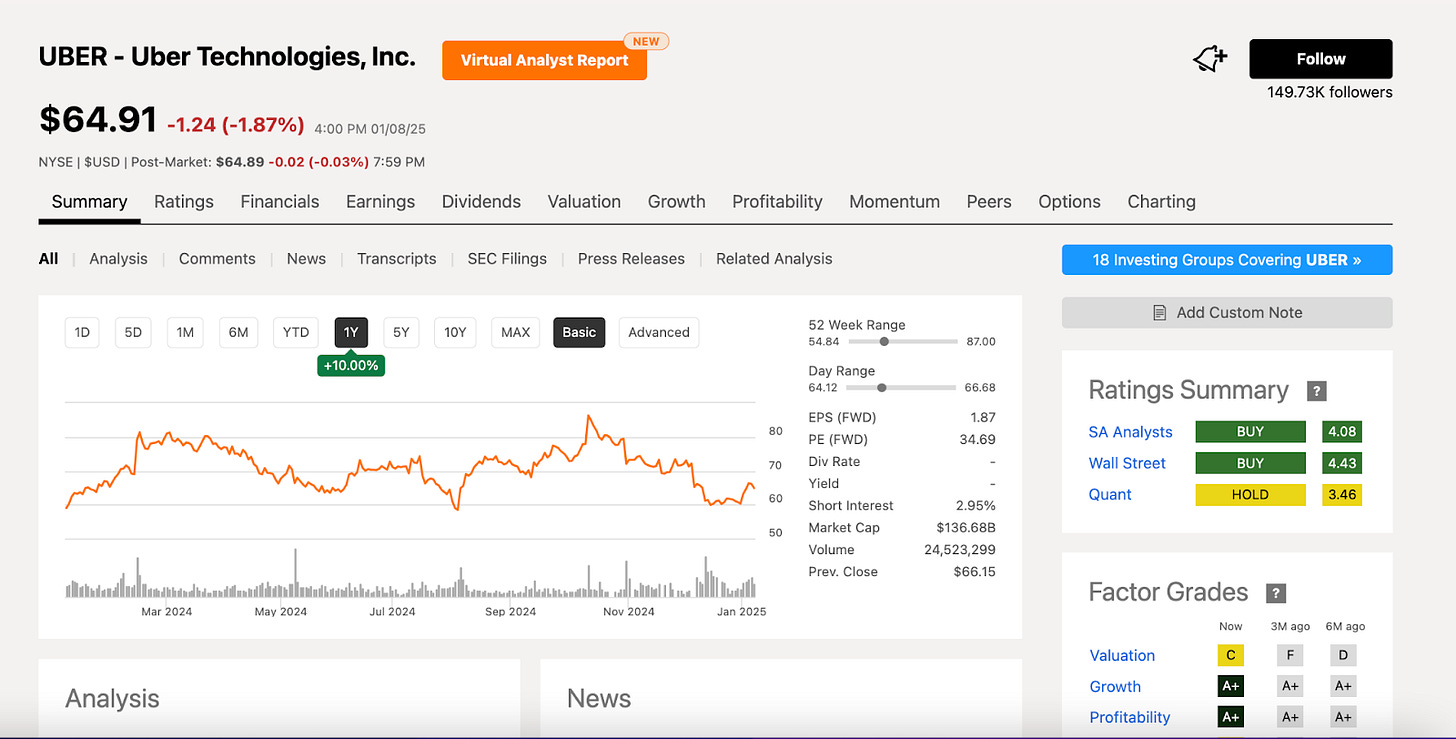

Uber Technologies UBER 0.00%↑

This has been a household name for a while, and I think most of us can agree the company is not going anywhere.

But while many big tech companies have had a strong rally in the last month, Uber has been selling off, down over 15% since its ATH.

It’s hard to say why exactly. After the election, it seems that many investors began to invest in Tesla, expecting it to dominate the self-driving market and perhaps compete with Uber through its plans to start its own robotaxi service.

However, even if this does come to fruition, it will still be years before Uber feels any real threat.

In the meantime, this is a company with growing revenues, positive and fast-growing earnings, and the potential to break into the autonomous vehicle market.

Uber will be utilizing NVIDIA’s Cosmos and DGX Cloud systems, which will be feeding off UBER’s vast real-life data.

If you ask me, this is a match made in heaven.

Yet, Uber trades at a ridiculously low PEG and a PE of only 20, which is cheap in this market.

This is for a stock that is expected to grow revenues and earnings by 50%

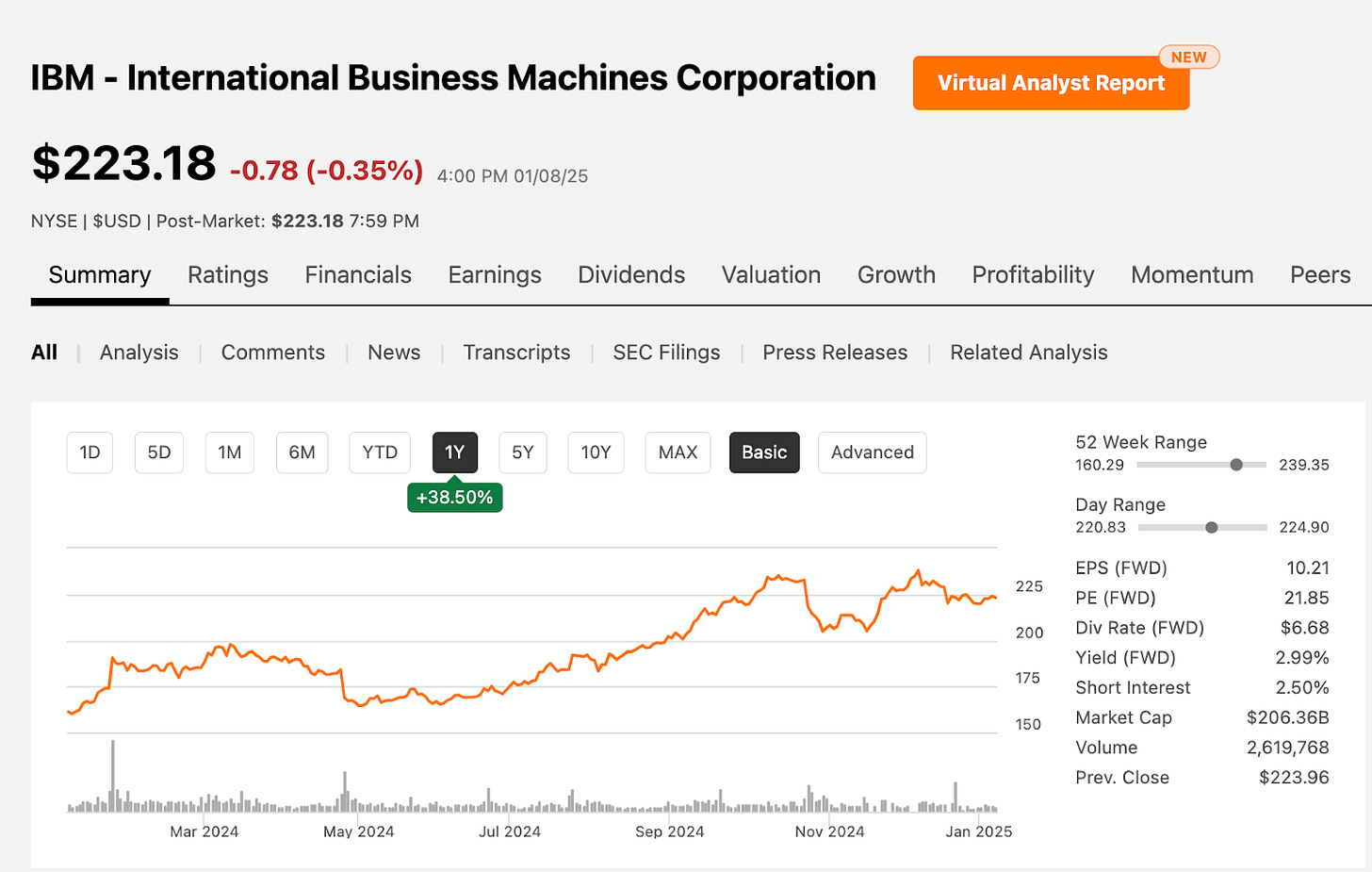

International Business Machines IBM 0.00%↑

The quantum hype has come and gone just as fast. Jensen poured cold water on the whole thing when he said he expected meaningful progress to take at least a decade.

Still, if quantum computing becomes a reality, I’d argue that working for IBM is a good way to gain exposure.

This old tech titan has had a good year, repositioning itself to benefit from AI and with some interesting quantum developments, too.

IBM has been at the forefront of quantum computing, achieving significant milestones in recent years. In 2019, they introduced the IBM Q System One, the world's first integrated quantum computing system for commercial use.

In June 2023, IBM's quantum computer outperformed a classical supercomputer on a complex physics problem, demonstrating quantum utility.

Additionally, IBM's cloud-based Quantum Platform has enabled over 80,000 users to run millions of experiments, fostering a global quantum research community. citeturn0search12

IBM has also benefited from AI, particularly through Generative AI (GenAI), which has reinvigorated its business trajectory and positioned it as a leader in open-source AI solutions. The third-generation Granite AI models exemplify IBM’s focus on practical developer value, driving double-digit growth in its Software segment. This segment, accounting for 45% of revenue, has been bolstered by the Red Hat platform and AI automation offerings like OpenShift AI and Ansible.

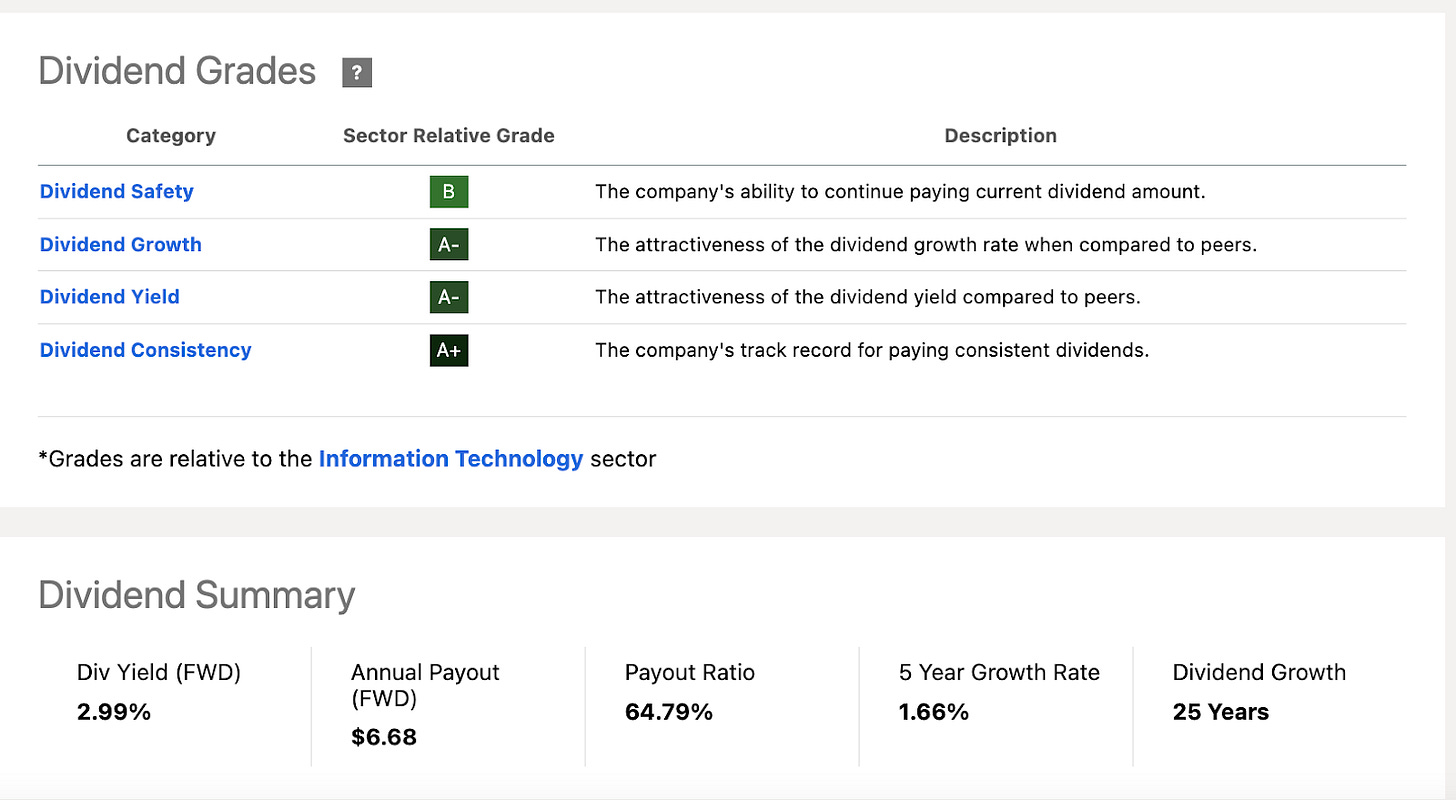

IBM won’t likely appreciate another 30% in 2025, but I expect it to do well. Through an attractive 3% yield, you have a very nice income/value tech stock.

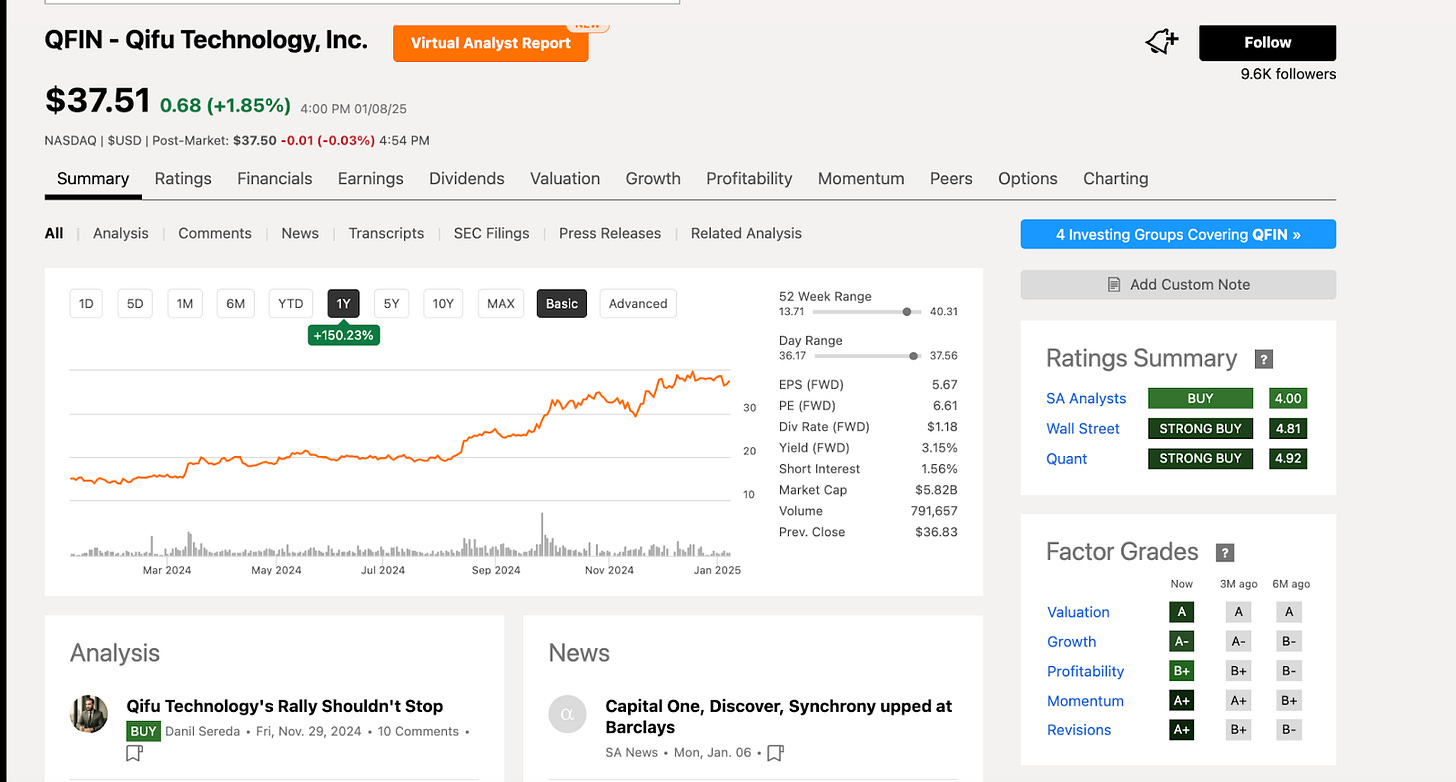

Qifu Technology QFIN 0.00%↑

Qifu Technology is poised to benefit from China’s recent economic stimulus efforts, including lowered interest rates and increased liquidity in the banking system. These measures make borrowing more attractive, driving demand for Qifu’s credit-tech services. With a platform that connects borrowers and financial institutions through tools like its 360 Jietiao app, Qifu is well-positioned to capture growth in the lending ecosystem.

Qifu’s strategic focus on asset quality, operational efficiency, and AI-driven technology enhancements has bolstered profitability, with Q2 2024 net income rising 26% year-over-year. The company’s improved risk profile and reduced funding costs have strengthened its financials, setting the stage for sustainable growth. Additionally, its low customer acquisition costs and focus on high-value users support long-term scalability.

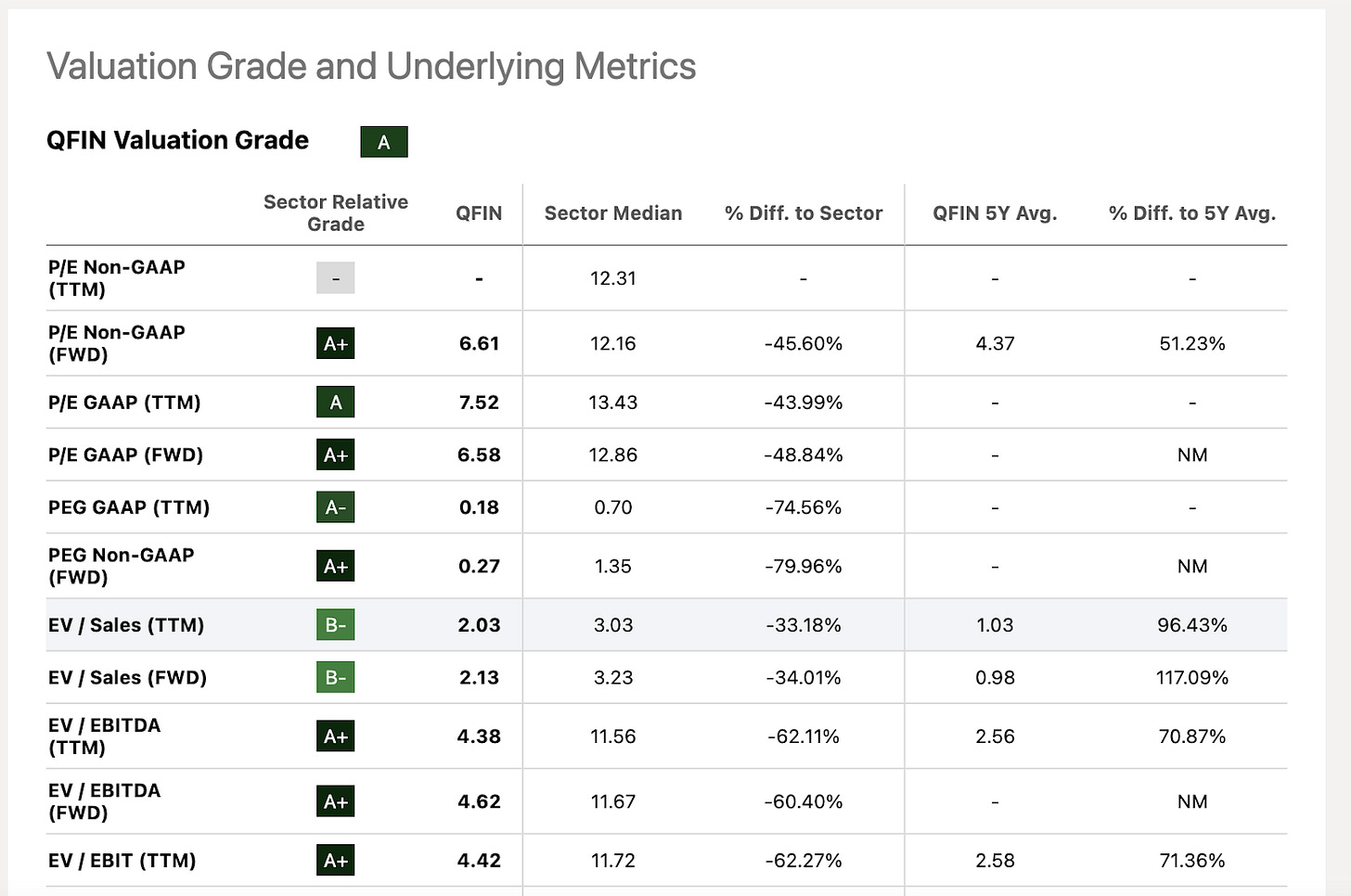

At just 5.6x expected 2025 EPS and a PEG ratio of 0.35, Qifu is undervalued compared to industry peers, leaving significant room for price-to-earnings (PE) expansion. With EPS expected to grow 6% in 2025 following 39% growth in 2024, Qifu’s conservative estimates could be revised upward.

While near-term pullbacks are possible, Qifu’s strategic initiatives and China’s economic tailwinds create a compelling case for robust growth, making it an attractive trade for 2025.

Final Thoughts

2025 presents exciting investment opportunities despite many stocks trading at all-time highs.

Thorough research reveals three standout picks:

UBER: Positioned for growth with NVIDIA partnerships, autonomous vehicle potential, and a low PE of 20 amidst 50% revenue and earnings growth projections.

IBM: A value-tech play with quantum computing and AI advancements driving double-digit Software segment growth, coupled with a solid 3% dividend yield.

QFIN: Benefiting from China's economic stimulus, Qifu offers undervaluation. Its strong earnings growth, low customer acquisition costs, and scalable fintech services make it an attractive 2025 trade.

These picks provide diverse avenues for portfolio growth.