Why I Choose to Rent: An 8-Figure Investor's Insight on Avoiding Real Estate Investments

Renting was never as cheap as it is today when compared to buying.

Welcome to Signals.Doctor. Today, I address a provocative topic: Why I Rent My Home and Advocate Against Real Estate Ownership.

TL;DR: Buying is for very rich people. If you’re not rich that 6-7% APR will be the biggest factor keeping you poor forever.

I realize people get very emotional about their 20- and 30-year financial commitments when someone is saying that they made the wrong decision. If you got a fixed mortgage at 2% APR, good for you. But many people didn’t.

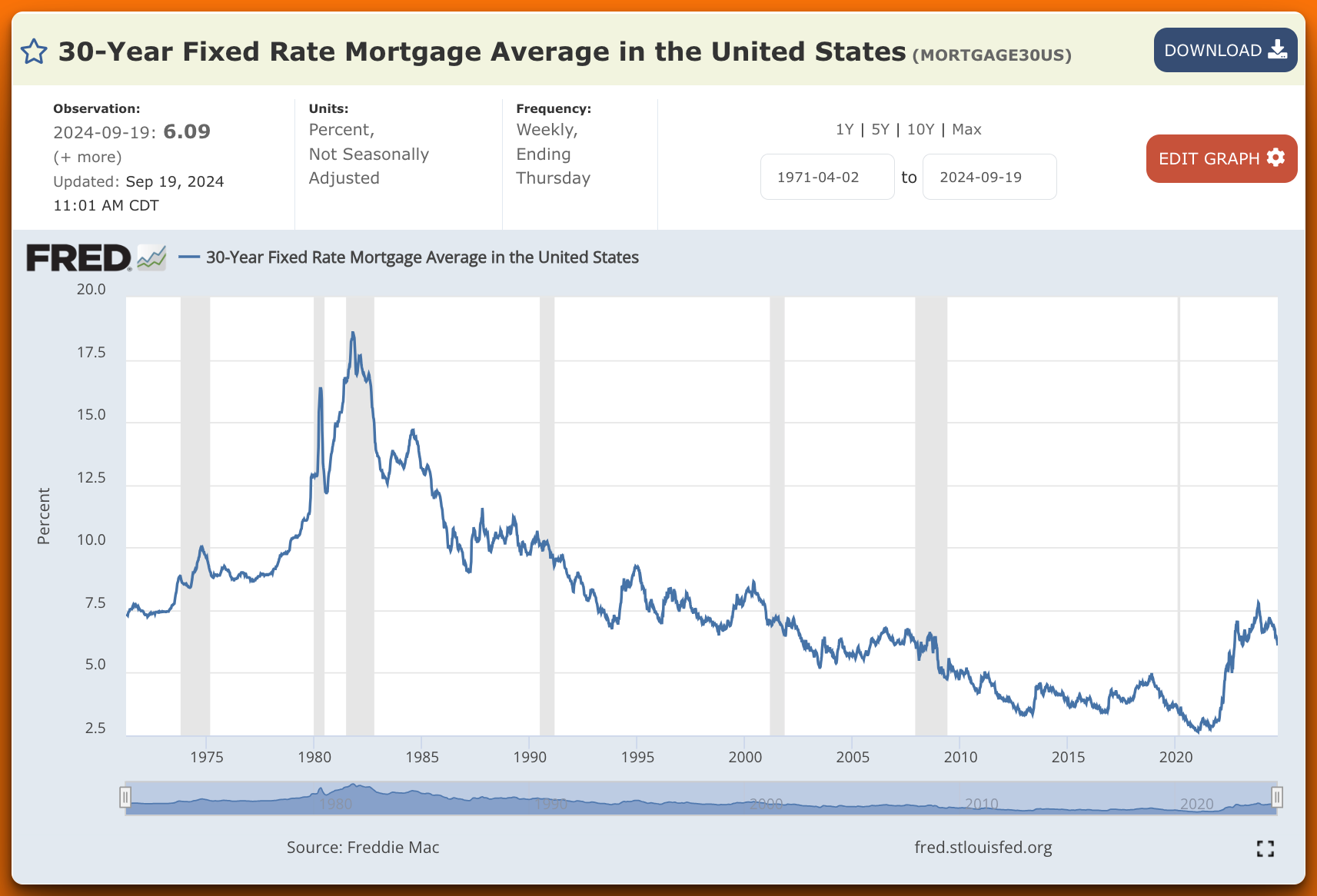

Historical 30 year APR:

In the later part of the article I also answer the question when you should buy a house:

My main point is that NOW is a very bad point in time to get a mortgage due to interest rates and let’s be real – a lot of people will get 7% APR.

To the people objecting to the $1.2M price - that’s just an example from an area that I lived in. It doesn’t matter if the house costs $200k or $2M. The calculations are the same (although with cheaper houses, repair and maintenance costs have a floor level that doesn’t scale linearly).

Cheers!

Reimagining the American Dream: The Homeownership Facade

Beyond the Iconic Suburbia

The American Dream often conjures images of sprawling suburban homes, where families thrive in spacious backyards and communities are tightly-knit. This idyllic portrayal isn't a natural evolution but the product of decades-long, strategic marketing campaigns orchestrated by influential bodies like the National Association of Realtors, recently subjected to a $1.2 billion judgment for deceptive practices.

Urban Realities: A Contrast in Living Standards

Contrary to the American emphasis on single-family homes, many cultures worldwide prioritize multi-family dwellings and rental living. Cities across Europe, Asia, and other regions predominantly feature high-density apartments and rental communities as the norm.

The Obsolete Financial Blueprint of Homeownership

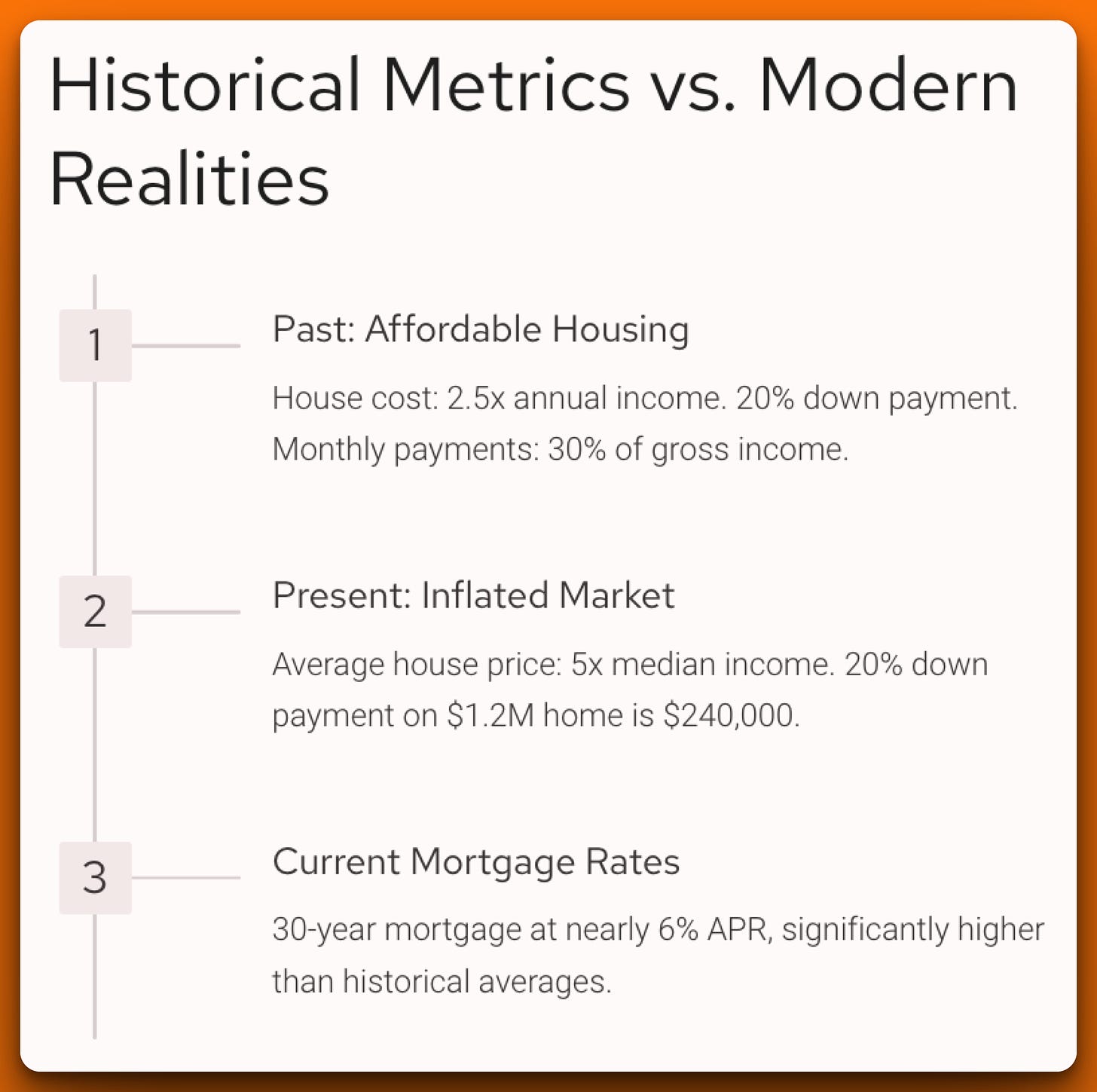

Historical Metrics vs. Modern Realities

In previous decades, purchasing a home was a straightforward financial decision:

House Cost: Approximately 2.5x annual income.

Down Payment: 20% of the purchase price.

Monthly Payments: Limited to 30% of gross income, covering mortgage, maintenance, insurance, and taxes.

Example:

Income: $60,000/year

House Price: $150,000

Down Payment: $30,000

Monthly Payments: $1,500

Current Reality (2024):

Average House Price: 5x the median income.

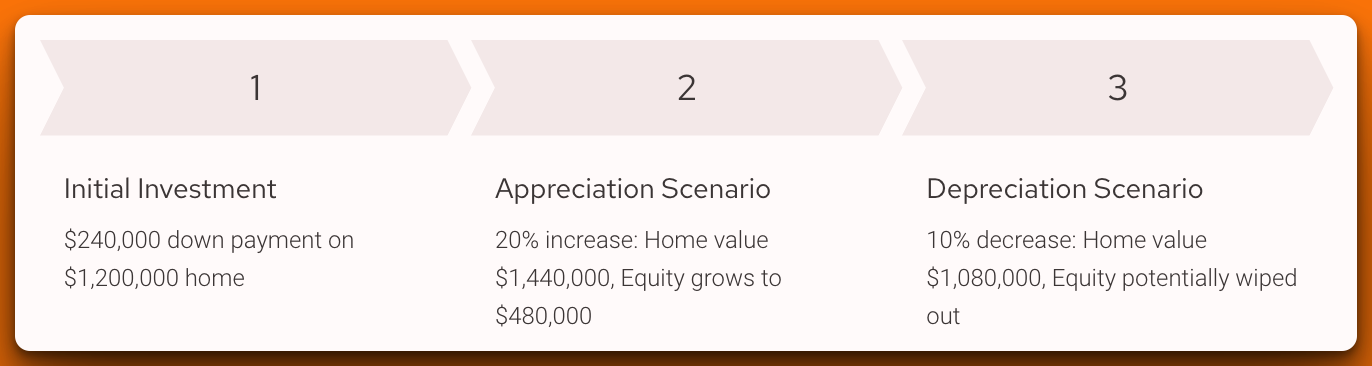

Down Payments: Consistently set at 20%, totaling $240,000 for a $1,200,000 home.

Mortgage Rates: A typical 30-year mortgage now stands at almost 6% APR, up significantly from historical averages.

Monthly Payments: Elevated by higher interest rates, making previously affordable homes prohibitively expensive. For a $1,200,000 home:

Down Payment: $240,000 (20%)

Mortgage Amount: $960,000

Monthly Mortgage Payment (Principal & Interest): Approximately $5,760

Additional Monthly Costs:

Property Taxes: $2,000

Insurance: $250

Maintenance & Repairs: $3,000

Total Monthly Ownership Cost: $10,010

This shift renders traditional homeownership metrics obsolete, amplifying the financial risks and burdens associated with buying property today.

Below you will find several case studies with investment calculations, myths about real estate renting, and essential question to make the right decision.

Debunking the Four Major Myths of Homeownership

Keep reading with a 7-day free trial

Subscribe to The Stock Insider to keep reading this post and get 7 days of free access to the full post archives.