🩻 Guess What? My Fortress Of Solitude Portfolios Destroyed SPY and QQQ Since Inception

Not only they both made more money, they are almost infinitely less risky

To Smart Investors.

First, an announcement:

Cyber Monday – Monday, December 2, 2024—will be the last chance EVER to get a Founding Lifetime membership for $500.

After that, there will NEVER be any more lifetime memberships, and we will switch to $500/year subscriptions only, with the price going up every time I release a new product.

Subscription includes access to:

My Stock and ETF portfolios

The Telegram Signals Channel

The TradingView Indicator, which is 90% accurate in predicting trend reversals and will be released in 1-2 weeks (Go here to sign up now, and you will get TradingView 70% off on Black Friday)

A future secret SaaS product (2025)

These are the Fortress of Solutide Stock Portfolios in question:

The idea is that these are stocks that you can keep for a decade without worrying about any market changes or who the current President is.

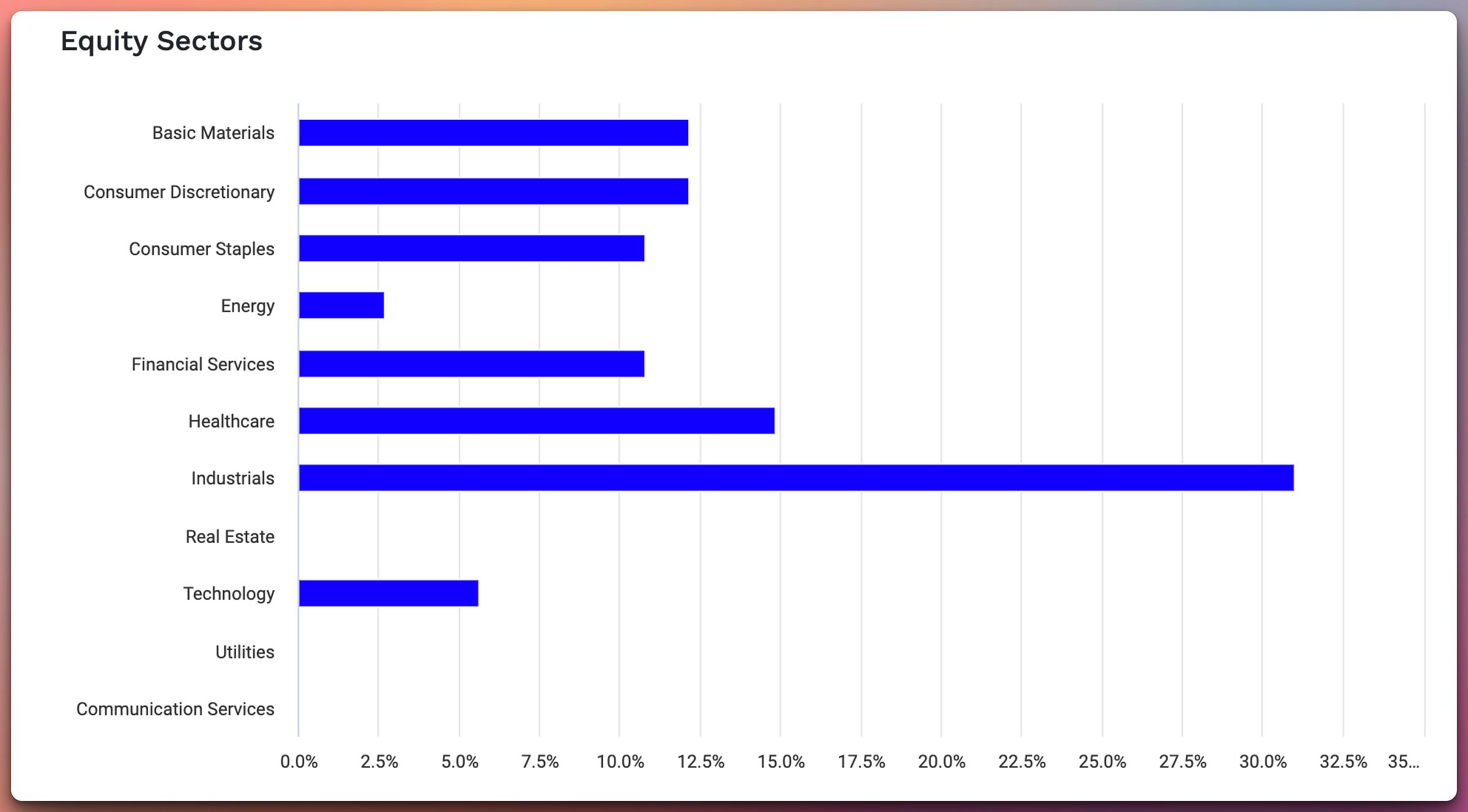

We focus on sectors people will ALWAYS need—real estate, finances, construction, chemicals, perishables, and energy—and NOT on temporary trends like AI, unicorn Tech companies like self-driving taxis or WIFI-connected juice quizzers.

At this point, almost 40% of the S&P500’s market capital is comprised of the so-called Magnificent 7 companies: Alphabet (GOOGL; GOOG), Amazon (AMZN), Apple (AAPL), Meta Platforms (META), Microsoft (MSFT), NVIDIA (NVDA), and Tesla (TSLA). During a true recession, these companies will be obliterated because they produce mostly non-essential goods or services.

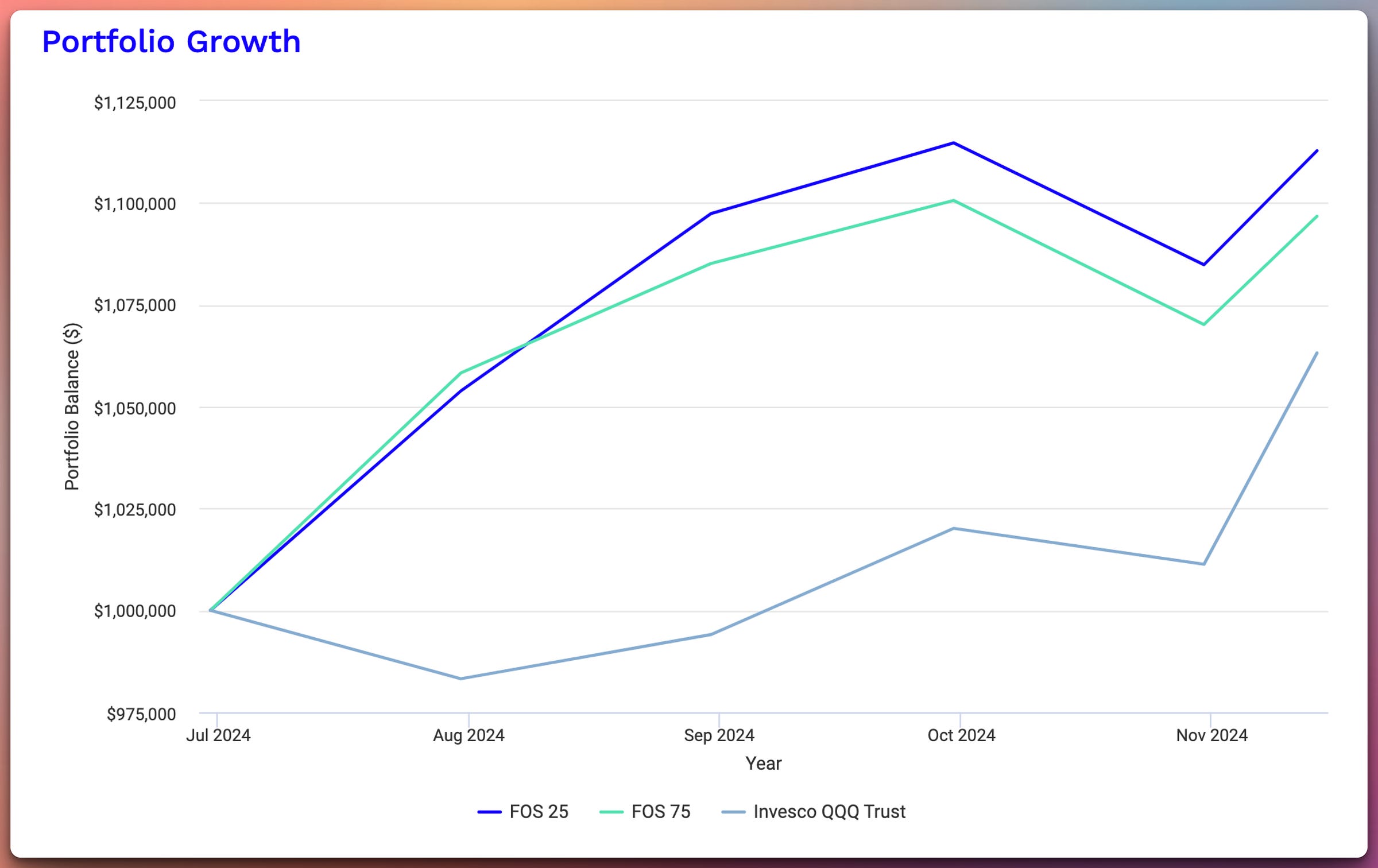

I didn’t plan for these portfolios to outperform QQQ or SPY. But. They did…

Turns out I’m REALLY GOOD at picking stocks.

Here are the graphs comparing my forever portfolios to SPY and QQQ since I posted them:

I honestly had no idea this would work SO WELL.

All the best,

Jack Roshi, PhD

Could you do an end-of-year analysis on your FoS portfolio?

Thanks!

Do you have such analysis for FOS25?

I’ve implemented it with real money since 27th August 2024.

So far SPY is up 4.52% while FOS25 is 2.71%.

Do you find similar results ?

Thanks!