Potential Returns: 💰💰💰💰💰 (5/5)

Risk Level: 🛡️🛡️🛡️🛡️⚪️ (4/5)

Complexity: ⚪️⚪️⚪️⚪️⚪️ (0/5)

In a world of economic uncertainty, wouldn't it be great to have a portfolio that consistently generates income, regardless of whether we're in a bull or bear market?

And I’m not talking about simple dividend stocks. Something much, much better than that.

What if I told you that such a portfolio exists, and it's surprisingly simple?

Today, I'm going to reveal a game-changing strategy that has the potential to revolutionize your investment approach. This isn't just another run-of-the-mill portfolio suggestion – it's a carefully crafted, thoroughly tested strategy designed for investors with significant capital who want to maximize their returns while minimizing risk.

Why This Portfolio Matters

Bear Market Shield: This portfolio is specifically designed to provide a hedge against market downturns. When others are panicking, you'll be calmly collecting your dividends. These specific 7 methods are used by the ETFs I have chosen:

Dynamic Asset Allocation

Options Strategies Enhancement

Dividend Strategy Adaptation

Volatility Management

Fixed Income Tactical Moves

Systematic Rebalancing

Covered Call Strategies

Bull Market Bonus: While primarily focused on income, this portfolio doesn't completely sacrifice growth potential. You'll still benefit from market upswings, albeit in a more measured way.

Diversification Dynamo: The three ETFs in this portfolio have minimal overlap, providing true diversification that goes beyond traditional sector allocation.

Capital Efficiency: For those with substantial investable assets, this portfolio offers an excellent complement to growth-oriented strategies. Imagine putting 75% of your capital in a growth portfolio (like my popular 2-ETF QQQ/VOO strategy) and 25% in this income powerhouse.

Consistency is Key: Whether the market is soaring or plummeting, this portfolio is designed to keep the cash flowing. It's about sleeping well at night, knowing your income stream is stable. It will sustain your lifestyle until we are back in the bull market and you can take gains from your growth portfolio.

The 3-ETF Income Portfolio: A Sneak Peek

This portfolio consists of three carefully selected ETFs, each playing a crucial role in generating consistent income.

They employ sophisticated strategies including options writing and volatility plays to squeeze out impressive yields without taking on excessive risk.

Here's a glimpse of what these ETFs can offer:

ETF 1: Approximately 7% annual yield

ETF 2: An impressive 16% annual yield

ETF 3: About 9.5% to 10% annual yield

To put this in perspective, let's consider a hypothetical $1 million investment in this portfolio. Based on these yields, you could potentially generate up to $110,000 in annual income. That translates to over $9k per month!

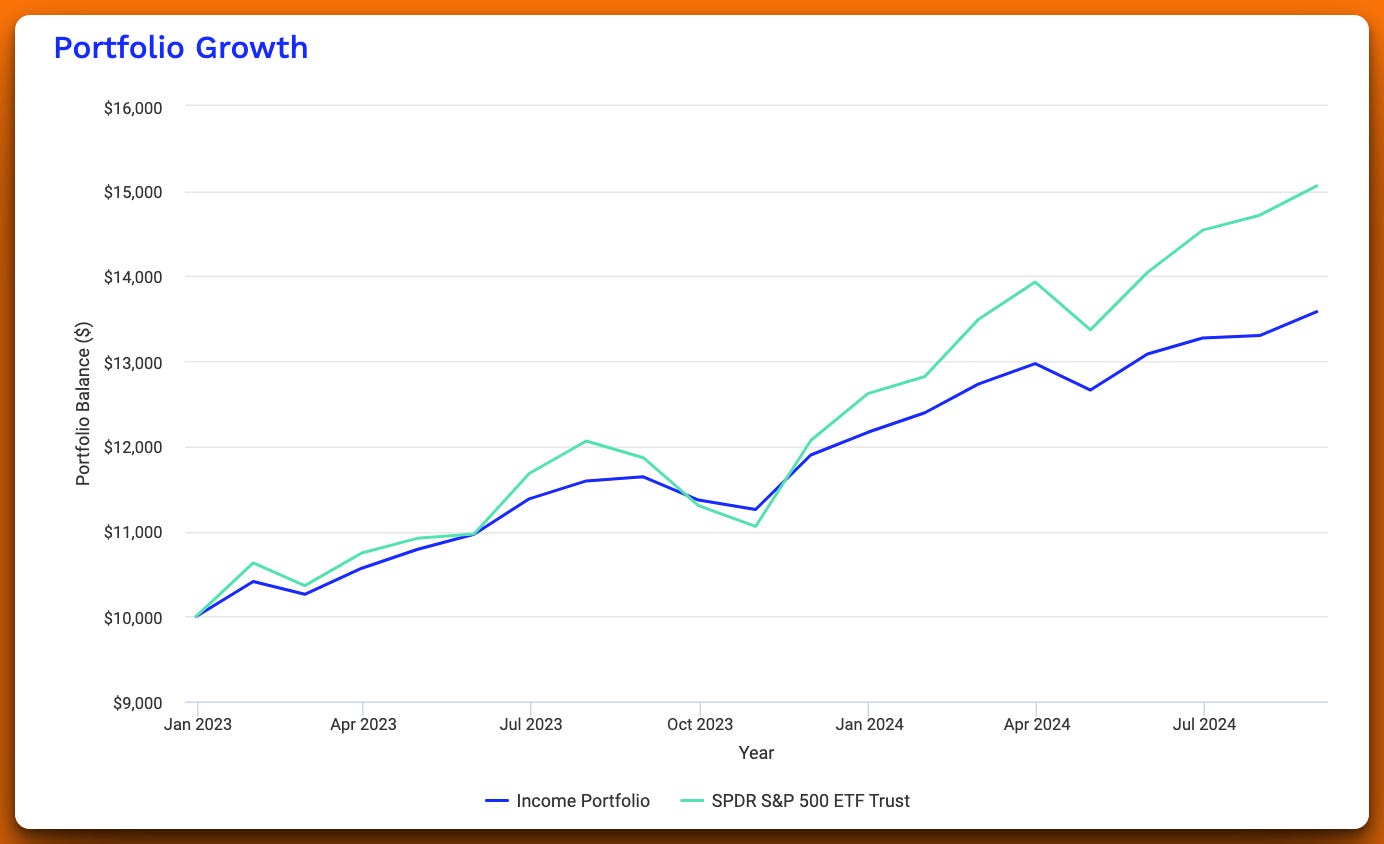

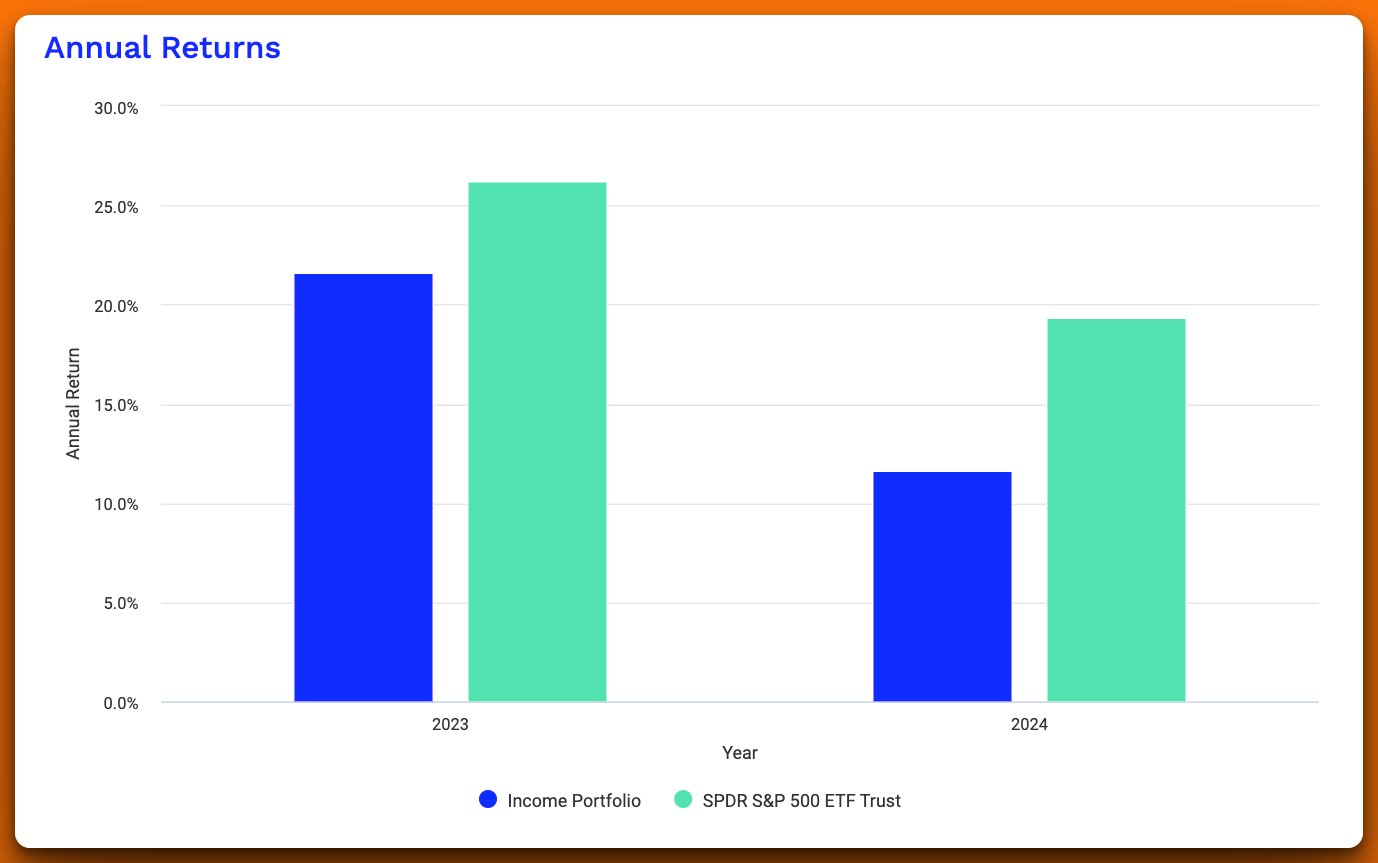

And the best thing. It doesn’t even perform badly compared to the S&P 500 growth-wise:

Of course, these figures are based on current yields and are subject to change. But they illustrate the income-generating potential of this carefully constructed portfolio.

In the paid sections, we'll dive deep into each ETF, explaining their strategies, yields, and how they work together to create a robust income-generating portfolio. And especially how they operate during bear markets.

You'll learn how to implement this strategy, adjust it based on market conditions, and potentially transform your investment approach.

If you're ready to take your income investing to the next level, read on.

Your financial future might just depend on it.

The Big Reveal: Your 3-ETF Income Powerhouse:

Keep reading with a 7-day free trial

Subscribe to The Stock Insider to keep reading this post and get 7 days of free access to the full post archives.