🩻 The Telegram Signals Channel: Outperforming Markets with Smart, Small Trades

Position Sizing, Frequency, and the Statistical Secrets to Outsmarting the SPX and Nasdaq

Hello Smart Investors!

I know a lot of you have questions about the Telegram Signals Channel.

I am making this post to explain everything in one place.

I have to preface saying that I’m not your financial advisor, and none of this constitutes financial advice.

Access

If you are a paid subscriber and you haven’t received the link to the Telegram Channel, please email me at jack@dailymoat.com

If you want access to the Signals Channel, you have to become a paid subscriber. The link to the channel should come in the welcome email. Again, please email me if it doesn't.

I will be limiting access to the channel to 1,000 people for the reasons described later in this post.

Performance So Far

In short, combined with my True Price TradingView Indicator, I’m making around 1%/day using the signals.

We invested over $500,000 in an NVIDIA DGX B200 supercomputer to enhance our services, including machine learning AI capabilities for the Signals Channel.

About The Channel

The podcast above provides a beginner-friendly explanation of most of the things in this article.

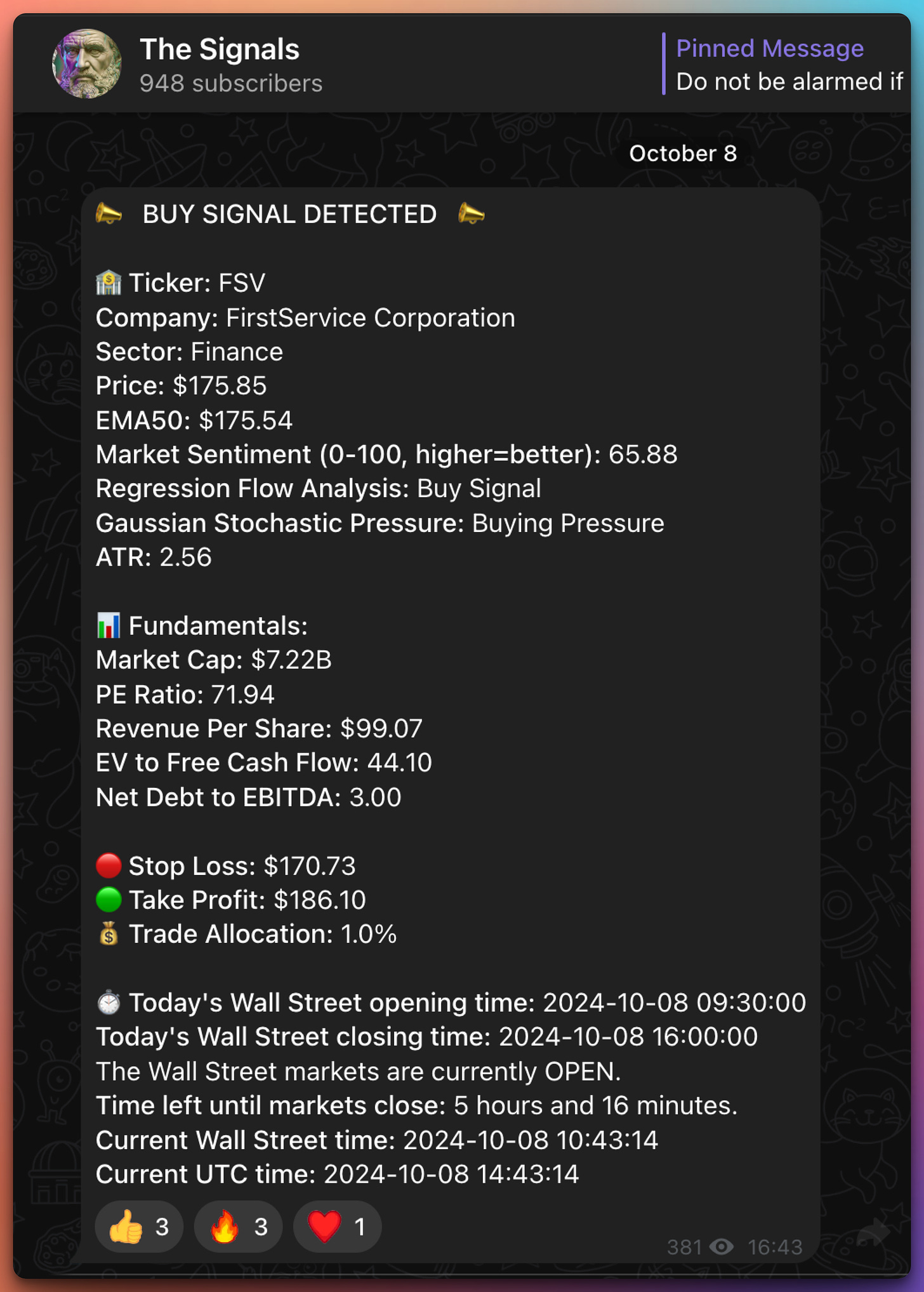

The Telegram Signals Channel is a channel that sends buy signals with stop-losses and take-profits, which I execute and chart their performance. These are the trades that I make with my own money. A signal looks like this:

Super-short TL;DR:

In trading, small, frequent trades with disciplined position sizing (0.5–2% of capital per trade) are mathematically and psychologically advantageous for long-term profitability.

Do not take these signals at face value. This is not financial advice. Do not just copy Stop Losses and Take Profits and leave it be. Understand what is happening here. Use the TradingView Indicator.Regular TL;DR:

For those following my signals on Telegram, the strategy behind the stop losses and take profits is built on sound mathematical principles. By keeping trade sizes small (0.5-2% of capital per trade), we minimize the risk of losing significant capital, even if a few trades go against us. The use of stop losses limits downside risk, while take profits ensure we lock in gains when the market moves in our favor. This approach, combined with frequent trades, allows the statistical edge of our quant system to play out over time, smoothing out the effects of losses and increasing long-term profitability.

Do not share the signals or access to the Telegram Channel with anyone. I will likely find out and ban you. The reason is not that I’m against piracy, or that I’m so greedy, but as another Smart Investor(thanks, Abhi) pointed out today – “[…]based on the number of paid subscribers you have and if they participate in your signals with significant capital, your stock recommendations can become volatile.” Although, I think we don’t have to worry about it at this point, if people would share the signals with thousands of other investors, it could become a problem on smaller caps.

Never invest what you can’t lose.

I am NOT your financial advisor. I am publicizing my own personal trades for educational reasons 😎

By keeping trade sizes small (ALWAYS 0.5-2% of capital per trade), we minimize the risk of losing significant capital, even if a few trades go against us. In extreme cases, the algorithm might allocate up to 3% to a trade, but that will happen rarely.

We are setting stop-losses and take-profits which are indicated in the signal, just like the % of trade allocation of your capital. This eliminates the psychological element of active trading which is the major reason that ruins your gains. The idea is to participate in all trades at the price disclosed and not chase the price manually as the range between stop-loss and take-profit prices are relatively small.

Again in very simple terms – I buy, as fast as I can with the indicated % of capital, set stop-loss, take-profit, and forget about that ticker until it hits the ceiling or the bottom.

I am investing my own money into this and will be reporting results of my gains.

The quant system is monitoring over 30,000 tickers in real time. And in great details these 2,580 companies from NYSE and Nasdaq–Here is the list in Excel format:

The Intricate Details of Why This All Works Out

I am an Insider:

I was a quant at Knight Capital Group, Inc.(KGC that later was absorbed by Virtu Financial). I lead the High Frequency Trading team and traded $6.1B Assets Under Management at peak. Literal Wolf of Wall Street stuff.

I have a PhD in Applied Mathematics from MIT. My thesis was on Stochastic Applications in Financial Modeling.

I have plenty of friends at Inc. 500 corporations and top holding companies like Berkshire Hathaway, ARK, Renaissance Technologies, and others. I’m not implying anything illegal here. Just saying I understand how things work in this world.

Abstract:

This comprehensive analysis delves into the mathematical principles underlying a trading strategy that emphasizes small position sizes (0.5–2% of capital per trade) and a high frequency of trades.

By integrating empirical data, case studies like Virtu Financial, statistical theories such as the Law of Large Numbers, and advanced risk management techniques, we aim to provide traders with an in-depth understanding of why this approach can lead to consistent profitability while minimizing risk.

This deep dive is designed to empower traders who subscribe to our signals on Substack to either apply these principles in their trading or opt for diversified ETF strategies for long-term growth.

Understanding Risk of Ruin:

Mathematical Definition

The Risk of Ruin quantifies the probability that a trader's capital will deplete to a point where recovery is statistically improbable, effectively ending their trading career. It is influenced by factors such as the trader's edge, win-loss ratio, and position sizing.

Mathematically, the Risk of Ruin for a given trading system can be approximated using a formula that highlights how the number of consecutive losses required to reach ruin increases when the ratio of average loss to average win approaches 1. The higher this ratio and the more consecutive losses, the higher the risk of ruin.

Impact of Position Sizing

Position sizing plays a pivotal role in determining how many consecutive losses a trader can endure before ruin. By allocating a smaller percentage of capital per trade, the number of consecutive losses required to reach ruin increases, thereby reducing the overall risk.

For example, consider a trader with $100,000 capital:

Scenario 1: Allocates 10% per trade ($10,000)

After 10 consecutive losses, capital depletes significantly.

Scenario 2: Allocates 1% per trade ($1,000)

After 10 consecutive losses, only $10,000 is lost, preserving 90% of capital.

By reducing position sizes, traders can withstand longer sequences of losses, allowing their edge to manifest over time.

The Kelly Criterion and Optimal Bet Sizing

Derivation and Explanation

The Kelly Criterion, introduced by John L. Kelly Jr. in 1956, offers a formula to calculate the optimal fraction of capital to risk on each trade to maximize long-term capital growth without increasing the risk of ruin.

The formula is designed to calculate the optimal bet size based on the probability of winning and the expected returns relative to losses. In trading, this can be simplified to focus on the win rate and the average win-to-loss ratio.

Example:

Assume:

Win rate = 55%

Average win = $110

Average loss = $100

Win-to-loss ratio = 1.1

The result suggests risking a certain percentage of capital per trade, but many traders opt for a more conservative fraction (e.g., half-Kelly) to account for market uncertainties and estimation errors.

Practical Application for Traders

Conservative Approach: Use a fraction (e.g., 25%) of the Kelly Criterion to account for estimation errors.

Dynamic Adjustment: Recalculate periodically, as probabilities and average win-loss ratios change over time.

Risk Management: Set maximum limits to prevent overexposure during periods of high volatility.

By applying the Kelly Criterion judiciously, traders can optimize position sizes to balance growth and risk.

Expectancy and Edge in Trading

Calculating Expectancy

Expectancy measures the average expected return per trade, incorporating both the probability of winning and the average win/loss amounts. This calculation is crucial for determining whether a trading system is statistically profitable over time.

An expectancy greater than zero indicates a statistically profitable trading strategy over time.

Examples and Scenarios

Scenario 1: Positive Expectancy with Low Win Rate

Win rate = 40%

Average win = $200

Average loss = $100

Despite winning only 40% of the time, the trader expects to make $20 per trade on average due to larger average wins.

Scenario 2: Negative Expectancy with High Win Rate

Win rate = 70%

Average win = $50

Average loss = $100

This strategy is still profitable, but the smaller average win relative to the loss reduces expectancy.

Scenario 3: Negative Expectancy

Win rate = 45%

Average win = $100

Average loss = $150

Despite a near 50% win rate, the larger losses lead to a negative expectancy, indicating an unprofitable strategy.

The Law of Large Numbers and Trade Frequency

Statistical Foundations

The Law of Large Numbers (LLN) is a fundamental theorem in probability that states that as the number of trials increases, the sample mean will converge to the expected value. In trading, this means that the more trades you execute, the more likely your actual win rate and profitability will align with your system's statistical expectancy.

Coin Toss Analogy

The coin toss analogy illustrates how increasing the number of trials reduces variance and aligns outcomes with expected values.

Single Toss Scenario: High variance, unpredictable outcomes.

Multiple Tosses Scenario (e.g., 100): Expected wins and losses become more predictable, and variance decreases.

Implications:

Increased Confidence: More trials lead to outcomes closer to expected profits.

Reduced Risk of Loss: The probability of overall loss diminishes with more trades.

High-Frequency Trading Firms

High-frequency trading (HFT) firms exploit the LLN by executing millions of trades with tiny edges, virtually guaranteeing daily profitability.

Small Edges: Even minuscule profit per trade accumulates over a vast number of trades.

Low Variance: High trade frequency smoothens profit distributions.

Case Study: Virtu Financial

Overview of Operations

Virtu Financial is a prominent HFT firm known for its consistent profitability and minimal losing days.

Timeframe: Reported data over 1,238 trading days.

Losing Days: Only one losing day during this period (Virtu IPO Filing).

Trading Volume: Executes approximately 2.9 million trades per day across various asset classes.

Profitability Analysis

Key Metrics:

Win Rate: Approximately 51–52% (Bloomberg Interview)

Average Profit per Share: Estimated at $0.0027

Daily Profit from U.S. Equities: Approximately $440,000

Calculations:

Average Shares Traded per Day: 160 million shares in U.S. equities.

Estimated Trades in U.S. Equities:

Assuming an average of 200 shares per trade:

Number of Trades = 160,000,000 shares / 200 shares/trade = 800,000 trades

Statistical Improbability of Losses

Using the binomial distribution, we can calculate the probability of Virtu experiencing a losing day. With high trade volume, the probability of daily loss approaches zero, showing that with enough trades, the system virtually guarantees profitability on any given day.

Insights from Greg Laughlin's Study

Astrophysicist Greg Laughlin’s study of Virtu Financial revealed that the firm’s high frequency of trades minimized variance and ensured consistent daily profits. Virtu’s Sharpe ratio (a measure of risk-adjusted returns) was effectively infinite due to negligible variance, even with a 51% win rate.

Implications for Traders:

Trade Frequency Matters: Increasing the number of trades reduces the likelihood of daily losses.

Small Edges Compound: Even a small per-trade profit accumulates significantly over many trades.

Psychological Advantages of Small Trades

Emotional Resilience

Trading small amounts per trade reduces the emotional impact of losses and gains.

Reduced Stress: Smaller losses are easier to cope with psychologically.

Consistency Over Emotion: Traders are less likely to make impulsive decisions based on significant fluctuations.

Maintaining Discipline

A systematic approach with predefined position sizes enhances discipline.

Adherence to Strategy: Traders are more likely to stick to their trading plan.

Avoiding Overtrading: Smaller trades reduce the temptation to recover losses quickly through larger, riskier trades.

Advanced Risk Management Strategies

Diversification Across Trades

Allocating capital across a variety of trades reduces unsystematic risk.

Uncorrelated Assets: Trading assets with low correlation minimizes the impact of sector-specific events.

Trade Types: Incorporate different strategies (e.g., momentum, mean reversion) to diversify risk.

Volatility Scaling

Adjusting position sizes based on asset volatility ensures consistent risk per trade.

For example, if risking $1,000 per trade, the number of shares bought would be lower for a more volatile asset and higher for a less volatile one.

Correlation Considerations

Monitoring the correlation between trades prevents unintended concentration of risk.

Correlation Matrix: Analyze the correlation coefficients between assets.

Diversification Benefit: Ensure that simultaneous trades are not all exposed to the same risk factors.

Practical Implementation for Retail Traders

Defining Your Edge

An edge is the statistical advantage that makes a trading strategy profitable over time.

Data-Driven Signals: Use backtested signals with a proven track record.

Positive Expectancy: Ensure that the strategy has a positive expectancy based on historical data.

Position Sizing Techniques

Implement strict position sizing rules to manage risk.

Fixed Fractional Method: Risk a fixed percentage of capital per trade (e.g., 1%).

Volatility-Based Position Sizing: Adjust position sizes based on the asset's volatility.

Trade Execution Frequency

While retail traders cannot match HFT firms, increasing trade frequency within practical limits helps realize the edge.

Consistent Trading: Aim to execute a steady number of trades over time.

Avoid Overtrading: Do not compromise trade quality for quantity.

Monitoring and Adjusting Strategies

Regularly review trading performance and adjust strategies as needed.

Performance Metrics: Track metrics like win rate, average win/loss, and expectancy.

Strategy Refinement: Use performance data to refine signals and risk management practices.

Alternative: Investing in ETFs

For traders unable to actively manage numerous trades, investing in Exchange-Traded Funds (ETFs) offers a passive approach.

Diversification: ETFs provide exposure to a basket of securities.

Lower Risk: Reduces unsystematic risk associated with individual stocks.

Convenience: Less time-intensive, suitable for those unable to monitor the market actively.

Examples:

S&P 500 ETF (SPY): Provides exposure to 500 large-cap U.S. companies.

Sector-Specific ETFs: Focus on specific industries (e.g., technology, healthcare).

Addressing Common Misconceptions

Myth: Higher Trade Frequency Requires Higher Win Rates

Reality: Profitability can be achieved with win rates close to 50% or even lower if the average win exceeds the average loss.

Myth: Small Trades Yield Insignificant Profits

Reality: While individual profits are small, cumulative gains over many trades can be substantial.

Myth: Retail Traders Cannot Replicate HFT Strategies

Reality: While retail traders cannot match the speed and volume of HFT firms, the underlying principles of risk management and statistical advantage are applicable.

Myth: Frequent Trading Increases Costs Unmanageably

Reality: With competitive brokerage fees and careful trade selection, costs can be managed effectively.

Conclusions

The mathematical rationale for investing small amounts of capital per trade and increasing trade frequency is robust and grounded in fundamental statistical principles. By minimizing the risk of ruin through prudent position sizing and leveraging the Law of Large Numbers, traders can enhance the probability of consistent profitability.

Empirical evidence from high-frequency trading firms like Virtu Financial demonstrates the efficacy of this approach. While retail traders operate on a different scale, they can apply the same strategies to manage risk and capitalize on their edge.

Ultimately, whether traders choose to actively implement these principles or opt for diversified ETF investments, understanding the mathematical foundations empowers them to make informed decisions aligned with long-term financial growth.

References

Virtu Financial IPO Filing: SEC.gov

Laughlin, G. (2014). Insights into High Frequency Trading from the Virtu Initial Public Offering.

Bloomberg Interview with Doug Cifu: Bloomberg News

High-Frequency Trading Firm Virtu's Consistent Profitability: The Wall Street Journal

Kelly Criterion Explanation: Thorp, E. O. (1971). Portfolio Choice and the Kelly Criterion. In Stochastic Optimization Models in Finance (pp. 599-620). Academic Press.

Risk of Ruin Calculations: Balsara, N. J. (1992). Money Management Strategies for Futures Traders. Wiley.

NASDAQ Trading Data: NASDAQ Trader

FCC Wireless License Database: FCC.gov

Michael Lewis's "Flash Boys": Lewis, M. (2014). Flash Boys: A Wall Street Revolt. W. W. Norton & Company.

Astrophysics and Financial Modeling: Bouchaud, J.-P., & Potters, M. (2003). Theory of Financial Risk and Derivative Pricing: From Statistical Physics to Risk Management. Cambridge University Press.

Statistical Analysis in Trading: Tsay, R. S. (2010). Analysis of Financial Time Series. Wiley.

All the best,

Jack Roshi, MIT PhD

Having analyzed thousands of stocks for NASDUCK, I can vouch for your strategy: your sweet spot of 0.5-2% position sizing aligns perfectly with what separates successful systematic traders from the rest. This is the kind of real-world risk management insight retail investors rarely get access to.