Hello Smart Investors!

This one is special. If you want to get in on my quant signals Telegram Channel on Sunday, I urge you to read everything here.

I have already raised to price to $300/mo. This is the last time to get the lifetime deal at $500. After the signals go live I’m doubling the price. 14-day money-back guarantee if you’re not satisfied.

These Signals are game-changing and I’m putting my own money into all of the trades.

The podcast is a beginner friendly explanation of most of the things in this article.

Super-short TL;DR: In trading, small, frequent trades with disciplined position sizing (0.5–2% of capital per trade) are mathematically and psychologically advantageous for long-term profitability.

Regular TL;DR:

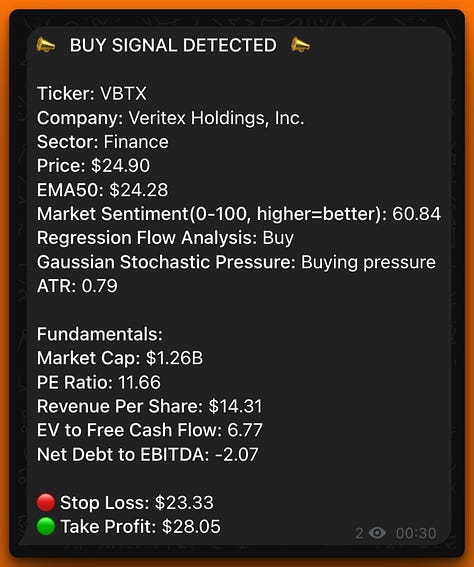

For those following my signals on Telegram, the strategy behind the stop losses and take profits is built on sound mathematical principles. By keeping trade sizes small (0.5-2% of capital per trade), we minimize the risk of losing significant capital, even if a few trades go against us. The use of stop losses limits downside risk, while take profits ensure we lock in gains when the market moves in our favor. This approach, combined with frequent trades, allows the statistical edge of our quant system to play out over time, smoothing out the effects of losses and increasing long-term profitability.

The 11-page in-depth report and mathematical explanations of all of this are paywalled at the bottom of this post.

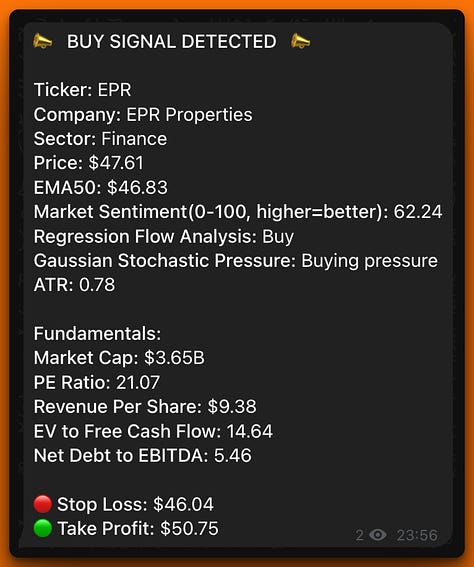

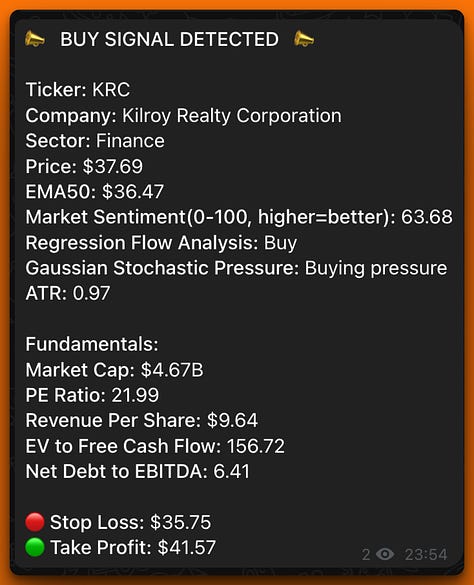

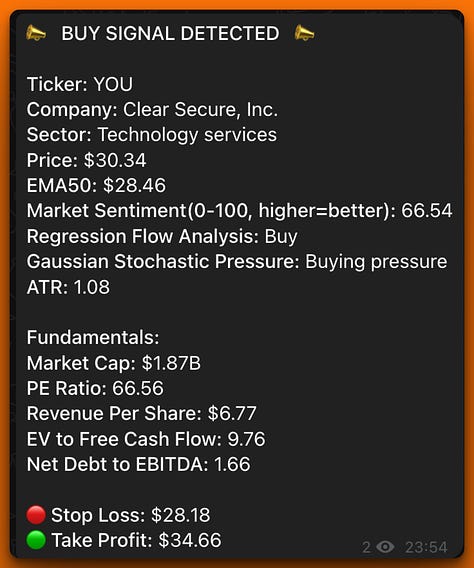

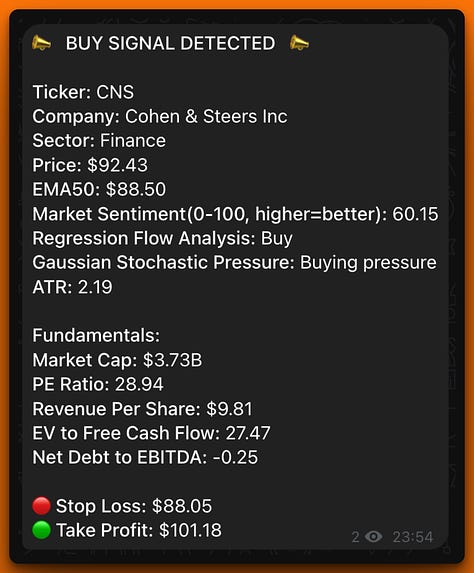

Example Signals From Right Now(Aftermarket):

Make sure you check out my Portfolios

ETFs:

Stocks:

Abstract:

This comprehensive analysis delves into the mathematical principles underlying a trading strategy that emphasizes small position sizes (0.5–2% of capital per trade) and a high frequency of trades.

By integrating empirical data, case studies like Virtu Financial, statistical theories such as the Law of Large Numbers, and advanced risk management techniques, we aim to provide traders with an in-depth understanding of why this approach can lead to consistent profitability while minimizing risk.

This deep dive is designed to empower traders who subscribe to our signals on Substack to either apply these principles in their trading or opt for diversified ETF strategies for long-term growth.

Understanding Risk of Ruin:

Listen to this episode with a 7-day free trial

Subscribe to 𝑻𝒉𝒆 𝑺𝒊𝒈𝒏𝒂𝒍𝒔 𝑫𝒐𝒄𝒕𝒐𝒓 to listen to this post and get 7 days of free access to the full post archives.