🩻 Week 2, 2025: Signs of Life in a Tough Market

A Look Ahead to CPI, Earnings, and Rate Policy

To Smart Investors,

We’re back with fresh, unbiased data for this week's US stock market.

Super Important Stuff!

The Oracle Indicator is getting its finishing touches to get out of Beta. An extensive guide on trading using it will follow.

I will post a very important article this week on the direction of our Signals and the explanations many people are asking for.

I hired several new people to help develop new products, but I’m still writing everything here and answering personally.

The work on the SaaS is being done:

The first eBook about the foundations of trading is finished. Now, it just needs to be edited and published. It is included in the subscription price. :)

The free weekly Podcast is here:

Stuff I Published Last Week:

As Always In The Sunday Report:

I have written a detailed recap of last week’s market, my predictions for next week, and an ELI5 (Explain Me Like I’m 5).

You can also find my typical quant data and the stock insiders’ significant buys/sells with my interpretation.

Every day, I post summaries of news relevant to Investors. I try to post about 30 minutes before the markets open and cover the last 24 hours of news. On the weekends, I post in the afternoon.

Use the secret code to get my daily news newsletter for just $1/month or $10/year.

S&P500 Heatmap over the last week

This graph was generated by our friends at TradingView. Did you know you can get 60% off the Premium plan forever, even though it's not Black Friday?

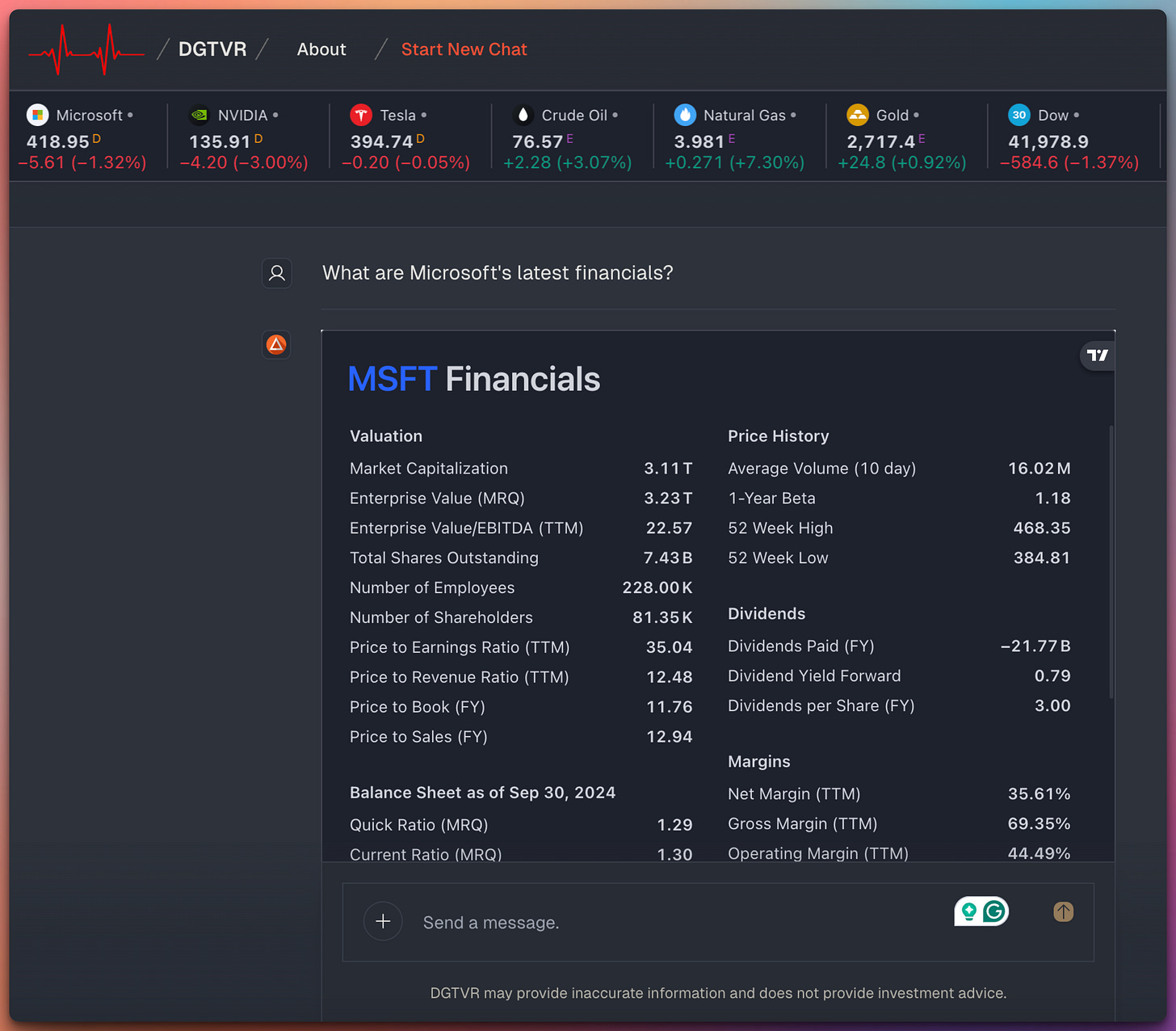

Excel data:

This graphs was generated by our friends at TradingView. Did you know you can get 60% off the Premium plan forever, even though it's not Black Friday?

*Also, by the way, the chart above shows precisely why you need the Premium TradingView plan in your life. Look into this:

SPY: 30-Day Technical Deep-Dive

Over the last month, SPY carved out a series of textbook patterns that have guided price action both up and down in a relatively tight range. Below is an expanded look at these developments and what they suggest about the weeks ahead.

1. The Double Top & Initial Breakdown

Context: In early December, SPY formed two prominent swing highs (near 600) that created a classic Double Top structure.

Significance: This pattern often forecasts a reversal when the neckline (around 590) fails. Indeed, price broke lower, confirming a bearish shift.

Following that breakdown:

Initial Sell-Off: SPY dropped sharply into the mid- to high-580s.

Brief Recovery: Bulls staged a modest bounce, but sellers quickly regained control at key resistance (~590–595).

2. Wedge Patterns Shaping Intraday Moves

Rising Wedge (Mid-December)

The rally off local lows formed a narrow wedge, ultimately breaking down and adding fuel to the ongoing decline. This wedge break helped SPY plunge from around 600 to ~580.Falling Wedge (Late December)

Soon after, a bullish falling wedge materialized. True to form, price popped higher out of that structure, but the move quickly stalled beneath a descending trendline overhead—reinforcing the broader downtrend.

These alternating wedge formations underscore how the market has been swinging between support near 580 and trendline resistance around 590–595.

3. Price Action Observations & Key Levels

Immediate Support (~580): Price has repeatedly tested this region. A decisive break beneath 580 increases the odds of probing the 570–575 zone.

Overhead Resistance (590, then 600): Any sustained close above 590 would represent a short-term momentum shift. Beyond that, 600 remains a strong pivot level from which the previous reversal started.

On lower timeframes, certain momentum signals are showing signs of flattening or minor bullish divergences—indicative that downside momentum could be slowing. However, until SPY can reclaim former support levels now turned resistance (around 590–595), caution remains warranted.

4. Momentum Hints & Forward Outlook

Even though SPY has stayed in a downtrend for much of the last month, forward-looking momentum readings (derived from leading oscillators) suggest a potential inflection point may be approaching. These signals often precede actual price reversals by several sessions. Here’s how that may unfold:

Short-Term (Days to ~1 Week)

There is a risk of more choppy weakness if 580 cracks, dragging price into the mid-570s.

Should the market stage a surprise move back above 590, we could see a quick burst higher toward 595–600.

Medium-Term (Next 1–2 Weeks)

A confluence of advanced metrics point to a possible bullish shift later this month. If confirmed by price action (i.e., a solid close above 590 and improving breadth), SPY could attempt a more decisive rebound toward 600+.

Conversely, if SPY languishes below 580 for too long, expect increased downside follow-through as sellers press their advantage.

5. Strategy Notes

Reactive, Not Predictive: Technical setups are probabilities, not guarantees. Maintain tight risk management as the market navigates a transition period.

Watch for Early Triggers: Keep an eye on price reclaiming key pivot levels (especially 590). A strong close back over that threshold would bolster the bullish argument.

Mind the Broader Trend: Even if a near-term bounce materializes, it must overcome persistent lower-high formations on the charts to confirm a sustained uptrend.

Please send feedback and ideas using comments, PMs, or email. I answer all emails and PMs personally. There is no personal assistant BS here.

And, as always — stay informed — and do your own due diligence,

Jack Roshi, MIT PhD

Weekly Market Summary: January 6 2025 – January 10, 2025

Executive Summary

Index Performance: U.S. equities posted their second straight weekly decline, with the S&P 500 and Nasdaq Composite down around 2% and the Dow Jones Industrial Average losing nearly 2%. Investor anxiety over interest-rate policy and sticky inflation accelerated the risk-off mood.

Rising Yields: Treasury yields surged, led by the 10-year crossing above 4.75% (the highest since November 2023) and the 2-year hovering near 4.40%. A stronger-than-expected labor market underpinned concerns that the Federal Reserve may pause further rate cuts.

Inflation & Jobs: The ISM Services PMI accelerated in December, while labor market data (nonfarm payrolls +256k, unemployment down to 4.1%) revealed unexpected resilience. Higher wage growth and elevated prices prompted skepticism over near-term Fed easing.

Sector Highlights:

Gainers: Energy, health care, and materials outperformed, helped by resilient commodity pricing and some defensive rotation.

Laggards: Real estate fell sharply as rising long-term yields pressured REITs. Tech also slipped, especially chipmakers confronting renewed export restriction risks.

Macro Data:

Factory orders declined slightly (-0.4% in November), but ex-transportation rose.

JOLTS job openings climbed, reinforcing that U.S. labor demand remains high.

Consumer credit unexpectedly contracted in November, suggesting caution in discretionary spending.

Below is a deeper look at the day-to-day action that shaped the week.

Detailed Analysis

Keep reading with a 7-day free trial

Subscribe to 𝑻𝒉𝒆 𝑺𝒊𝒈𝒏𝒂𝒍𝒔 𝑫𝒐𝒄𝒕𝒐𝒓 to keep reading this post and get 7 days of free access to the full post archives.